Clean energy credits will save Nevadans big bucks at home – The Nevada Independent – The Nevada Independent

Energy Disrupter

America’s transition to a clean energy economy will save Nevadans a lot of money on home energy costs and the Inflation Reduction Act (IRA), signed into law in August, will expand these cost-saving opportunities.

The IRA includes a number of residential subsidies and tax credits that can be used for home energy efficiency improvements such as upgraded windows, doors, insulation, heat pumps, electric water heaters, and electrical upgrades. Rewiring America estimates that “At least 85% of households in the United States — 103 million — could save $37.3 billion a year on energy bills if they were using modern, electrified furnaces and water heaters instead of their current machines.”

The IRA home efficiency programs will start in 2023. The amount of the upfront discounts and tax credits varies by income, with low- and moderate-income (LMI) households qualifying for more upfront discounts. Tax credits are available for higher income households.

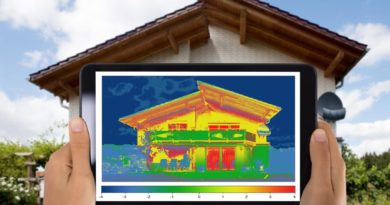

The first step in making your home more energy efficient (and thus saving money) is to get an energy audit. NV Energy will conduct an audit for free, and private home energy firms will conduct a more comprehensive audit. Some companies do this for free (with the hope that you will hire them to make insulation improvements), and some charge a fee. The IRA gives a credit of up to $150 for an energy audit.

A good energy audit will make recommendations for the most cost-effective energy efficiency improvements. For older homes, these might include better insulation in the attic and crawl space, duct sealing, and maybe window upgrades. Using less energy to heat or cool your home not only saves you money but is good for the environment and reduces pressure on the electrical grid.

All households will be able to access rebates of up to $4,000, and low-income households could receive up to $8,000 for home efficiency improvements. Last year, blowing additional insulation into the attic and sealing the heating ducts in my 1,840 square-foot house cost a little less than $4,000. Even with outside temperature highs in the 80s and lows in the 40s, our heat pump has not come on once in the last three weeks.

For most homes, heating and cooling use the most energy, so switching from a gas furnace to a high-efficiency electric heat pump will significantly reduce heating and cooling bills. Heat pumps transfer heat energy from outside your home to the inside. They will heat your home in the winter and cool it in the summer, much like your refrigerator cools your food. If you have a gas furnace and a central duct system, a heat pump can replace your existing furnace when it gives up the ghost. However, it is best to plan ahead for the switch to a heat pump and research the options. You don’t want to wait until your gas furnace dies, as there is usually a lead-time to get a heat pump installed.

For homes without ducts, there is a ductless version, called a mini-split heat pump, that will heat or cool individual rooms. You can learn more about heat pumps here. Beginning in 2023, state programs will offer low- and moderate-income households rebates for heat pumps at the point-of-sale, cutting costs of purchase and installation up to $8,000.

Last year, I replaced my 25-year-old gas furnace and AC unit with a heat pump. It cost $12,500 – just $500 more than my neighbor spent to replace his failing gas furnace with a new gas furnace. I will recoup the extra $500 through reduced energy bills in about two years. One thing I learned during the process was the importance of finding an HVAC contractor that is familiar with heat pumps. Several contractors I contacted had never heard of them. This will change as people realize how much money they will save on energy bills and demand increases.

The IRA also includes rebates and tax credits for replacing non-electric appliances with high-efficiency electric appliances, including water heaters, clothes dryers, stovetops, and ovens, as well as for upgrades to electrical wiring. The rules are complex; fortunately, Rewiring America’s website includes an interactive calculator that will give you an estimate of upfront discounts, tax credits, and energy bill savings for your home. They also have a comprehensive guide to the programs.

How much a household saves on energy costs depends on their income, size of house, and the upgrades they install. For Nevada, Rewiring America estimates that electrifying space and water heating would reduce energy bills for 1.1 million households by an average of $334 per year.

Installing heat pumps, electric water heaters, and stoves will create additional jobs for plumbers and electricians in our state, as well as indirect sectors such as manufacturing and finance. In short, the IRA will be an economic boost to Nevada and the country, while saving American households billions of dollars in home energy costs. No wonder it is supported by over 70 percent of American voters.

As beneficial as the IRA is in saving Americans money, it does not get us the greenhouse gas (GHG) reductions we need to avoid the worst impacts of a warming planet, nor meet the USA’s GHG reduction targets of 50 percent reduction by 2030 and net zero by 2050. For that, we will need additional measures such as a Carbon Fee and Dividend policy, which would place a steadily rising fee on carbon pollution and return all the money raised to the American people in a monthly dividend. Thousands of economists support this policy as the most effective way to reduce our GHG emissions. You can learn more about the policy here.

Chas Macquarie is a Carson City resident, a retired civil engineer, a member of Citizens’ Climate Lobby and an advocate for clean energy.

Original Source: https://thenevadaindependent.com/article/clean-energy-credits-will-save-nevadans-big-bucks-at-home