Here’s how the new US tax credits and rebates will work for clean energy home upgrades – Electrek.co

Energy Disrupter

US President Joe Biden signed the big climate bill – the Inflation Reduction Act (IRA) – earlier this week. Electrek spoke with Dan Gayer, JD, CPA, a senior manager in the tax practice at Baker Newman Noyes, about how homeowners can claim tax credits and rebates as they work to achieve energy efficiency and lower their energy bills.

Energy Efficient Home Improvement Credit

Changes to the former Nonbusiness Energy Property credit, now renamed the Energy Efficient Home Improvement Credit, will take effect on January 1, 2023.

The old credit was worth 10% of the costs of installing insulation, windows, doors, roofing, and other energy-saving improvements. The old $500 lifetime limitation still applies for the rest of 2022.

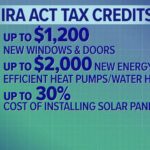

From 2023, a $1,200 annual tax credit limit will replace the old $500 lifetime limit. The tax credit will be equal to 30% of the costs for all eligible home improvements made during the year. It has also been expanded to cover things such as biomass stoves and boilers, electric panels, and home energy audits.

Beginning in 2023, annual limits for particular types of qualifying alterations were improved. For example, it’s $250 for an exterior door, or $500 for all exterior doors; $600 for exterior windows and skylights; and $2,000 for heat pump and heat pump hot water heaters for homeowners who don’t qualify for the rebate due to higher household income – see below. (The latter $2,000 is the exception to the $1,200 annual limit.)

Residential Clean Energy Credit

The Residential Clean Energy Credit, which is now extended through 2034, was previously called the Residential Energy Efficient Property Credit.

The credit amount for installing clean household energy such as solar, wind, or geothermal has been raised from 26% to 30% from 2022 to 2032. It then falls to 26% for 2033 and 22% for 2034.

Gayer says of the timing of household solar tax credits:

On the solar credits, both the residential credits and business investment tax credits are back to 30% effective for solar equipment placed in service any time after January 1, 2022.

Gayer went on to explain how homeowners can secure tax credits for both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit under the IRA umbrella:

The mechanics of claiming this credit appear to be the same in 2022 and 2023 as they were in the past – the credit is claimed on the purchaser’s individual income tax return. The purchaser does not need to submit specific documentation with the tax return, but should retain documentation as part of their tax records so they can prove they purchased eligible property in the event of an IRS audit.

Vendors should be able to provide purchasers with this type of documentation. In 2024 and future years, manufacturers need to create a specific product identification number for each qualifying product they sell, and purchasers must include this number on their tax returns to claim the credit.

High-Efficiency Electric Home Rebate Program

The IRA’s $4.28 billion High-Efficiency Electric Home Rebate Program will provide an upfront rebate of up to $8,000 to install heat pumps that can both heat and cool homes. It also provides a rebate of up to $1,750 for heat pump water heaters.

There’s also a rebate of up to $840 to offset the cost of a heat-pump clothes dryer or an electric stove, including induction ranges.

If a home needs an electrical panel upgrade to support new electrical appliances, then there’s up to a $4,000 rebate to help with that. There’s also a rebate of up to $2,500 for electrical wiring improvements.

And for one of the most cost-efficient and quickest ways to make a home more energy-efficient – insulation and sealing – there’s a rebate of up to $1,600.

Homeowners will be able to collect a maximum of $14,000 total in rebates. Household income cannot exceed 150% of the area median income as calculated by the Department of Housing and Urban Development in order to qualify. (Here’s an Area Median Income Lookup Tool from Fannie Mae to see what your limit is.) According to the bill itself, rebates start after December 31, 2022.

Gayer elaborated on the details of how the rebates will work:

The Inflation Reduction Act does not give specifics on how this rebate will be administered – the details here are left to the Treasury Department to issue general guidelines and then provide grants to state governments, who are the ones charged with actually implementing the program and giving out the rebates.

The intent here is to provide rebates to qualified purchasers at the point of sale, so this will be a direct discount on the purchase price rather than a credit claimed on a tax return.

Given how much still needs to happen at both the federal and state levels to write more detailed rules and get the necessary administrative procedures set up, it seems unlikely that this rebate program will be up and running until sometime in 2023, and the exact details of the program may be different in every state.

The rebate program will run through September 30, 2031, and the Energy Efficient Home Improvement Credit will run through 2032.

Photo: “Three pigeons on a roof” by Dunnock_D is licensed under CC BY-NC 2.0

Read more: If the big US climate bill passes, here’s how it could turbocharge solar and wind

UnderstandSolar is a free service that links you to top-rated solar installers in your region for personalized solar estimates. Tesla now offers price matching, so it’s important to shop for the best quotes. Click here to learn more and get your quotes. — *ad.

FTC: We use income earning auto affiliate links. More.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

[embedded content]

Original Source: https://electrek.co/2022/08/19/us-tax-credits-rebates-climate-law/