Solar tax credits and heat pump rebates: All the ways Build Back Better would incentivize cleaner energy at home – MarketWatch

Energy Disrupter

A handful of programs in the recently-passed infrastructure bill aim to help U.S. homeowners and renters heat and cool their homes, cook meals, and even shower — all while using less energy.

But it’s the still heavily-negotiated budget reconciliation bill, which Democrats have called Build Back Better, that packs the most energy-saving “carrots” for individuals and families, and which are meant to push the nation toward net-zero emissions by 2050.

“The framework, if approved, would represent the largest single investment in the clean energy economy in the U.S. and aims to cut greenhouse gas pollution CL00, -0.82% by over one gigaton in 2030 — 10 times larger than any legislation Congress has passed previously,” President Joe Biden has said.

The administration’s Build Back Better bill includes $555 billion in tax credits and incentives to promote wind and solar power ICLN, +2.64%, electric vehicles, climate-minded agriculture and forestry programs and other clean energy ideas, some at the federal and community level and some earmarked for American homes.

House Speaker Nancy Pelosi, on hand this week at the U.N.’s COP26 climate summit in Glasgow, repeated her expectations for Build Back Better to go up for a vote during the week of Nov. 15.

If passed in its current form, the legislation will include rebates for homeowners who make whole-home efficiency upgrades or flip from higher-emitting and often less-efficient heating oil, coal or kerosene furnaces and heaters to electric heat pumps — essentially the cold-weather equivalent to central air conditioning.

Eventually, green-energy groups and select lawmakers want a renewable energy-powered electricity grid (the source for those heat pumps) to replace natural gas-powered electricity. But the alluring competitive price of natural gas NG00 means that change won’t happen overnight, said Steven Nadel, executive director at the American Council for an Energy Efficient Economy.

“‘All of this is a gradual process.’”

Meanwhile, the $1 trillion Infrastructure Investment and Jobs Act that passed last week is meant to improve transportation and power infrastructure, and ensure clean water and broadband access across the U.S. over the coming decades.

Nadel called the infrastructure bill a starting point for energy-focused changes, including $3.5 billion in new funds for better access and more work crews for existing bipartisan programs that weather-proof homes with insulation and newer windows, especially for low-income neighborhoods.

Rebates for clean-energy upgrades at home

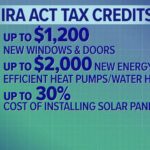

Some of Build Back Better’s key features related to homes and personal energy use include rebates totaling $5.89 billion for homeowners who make whole-home efficiency upgrades. This might include newer appliances, insulation, windows, water heaters and other changes. At least 25% of that is earmarked for low- and moderate-income households.

Broken down, that means rebates of $2,000 to $4,000 for middle-income earners and double that for moderate-income homes, which earn 80% of an area’s median income.

The “rebate” format is notable, Nadel said, because it will impact more people, unlike existing Energy Star tax credits on appliance upgrades and other efficiency moves. Many homes don’t make enough income for a tax credit to matter.

Separately, the bill calls for $6.25 billion in rebates for homeowners and multifamily building owners to electrify — such as with heat pumps, electric stoves and electric dryers — with $3.8 billion of this funding dedicated for low- and moderate-income households and tribal communities.

Homes with the electrical capability to power central air conditioning can typically handle a heat pump, but an electrician can advise if upgrades to the electrical box will be needed, probably to the tune of a few thousand dollars, Nadel said.

As for any added strain on the electrical grid serving a community, summer-peaking utilities that generate the most power during warmer weather will be able to support added heat pumps. Areas where summer and winter peak energy use is more closely aligned may have to assess how much generating capacity a grid has and update to add more, if more heat pumps come online, the experts said.

“A lot of new generation electrical power will be renewables,” said Nadel. “By and large, most of the country is ‘clean’ enough that switching to electric will lower emissions overall. That’s not true of heavy coal-use states, but even there, coal is being retired.”

“All of this is a gradual process,” he added.

Much of the Build Back Better legislation is meant to help solar manufacturing, with so-called production tax credits. When it comes to home solar panels, the Biden administration is largely pushing for extending the eligibility years for existing tax credits for those filers who qualify.

The Biden pitch says doing so will trim the cost of installing rooftop solar for a home by around 30%, shortening the payback period on a loan-financed system by around five years.

Depending on where you live and what solar energy system you install, at-home solar installations can lower household electric bills monthly, “with a long-term, low-risk investment,” the Environmental Defense Fund says in a release expressing its support for the bill. “From Florida to Texas to California to Massachusetts, installing a solar panel could give a single household up to $2,000 a year in savings,” the group said.

Build Back Better includes targeted grants and loans available to rural communities through the Department of Agriculture, with the intention that more accessible renewable energy sources and the savings they create will reach households all over the U.S.

Other features in Build Back Better

Build Back Better also proposes:

- $2 billion (with up to $4 billion in lending authority) for improving the energy and water efficiency — and climate resilience — of multifamily affordable housing;

- Updated and expanded tax incentives for efficient new and upgraded homes and commercial buildings, including expanded incentives for constructing new homes that are zero-energy ready and for deep energy retrofits of commercial buildings;

- $300 million to support the current model building codes and codes for zero-energy buildings;

- A $250 million program in revolving loans for home and small commercial energy-infrastructure upgrades, which stipulates that 60% of the money targeted must go to the 15 states with the highest per-capita energy use and highest greenhouse gas emissions. It was Sen. Joe Manchin, the Democrat who has forced several rewrites of Build Back Better, who pushed for this change for his home state of West Virginia and others.

At least one home-building trade group is concerned that extra regulation could add to construction costs, which could be passed on to consumers. Instead, the National Association of Homebuilders favors tax incentives.

“NAHB opposes costly code mandates in the Build Back Better Act, which fail to ensure that either the public interest or local input is reflected. NAHB has long advocated for using the tax code to promote greater energy efficiency without imposing costly mandates that harm housing affordability,” said NAHB Chairman Chuck Fowke.

“We are pleased to see long-term extensions included for many of the existing energy tax incentives, but we have concerns about relying on niche programs like Energy Star to qualify for those incentives,” Fowke said. “We also believe it is inappropriate to offer pay-outs for using apprentices or paying prevailing wages, which have nothing to do with energy efficiency.”

ACEEE’s Nadel said additional Build Back Better proposals that could impact homeowners lie within the bill’s push for states and municipalities to leverage federal programs with their own efforts.

Watch for promotional local materials toward energy-efficiency programs in the mail and elsewhere, he advises consumers.