Analysis: Is Germany’s onshore wind sector really back from the brink?

Energy Disrupter

German wind industry association BWE earlier this month declared that the “German wind energy industry is back” after bidding volumes reached a seven-year high in the country’s latest onshore wind tender.

It followed an acceleration of project permitting in recent years, with industry body WindEurope suggesting that approvals could this year exceed the 9GW-plus record set back in 2016.

Because commercial developers need these approvals to bid at auction – the main mechanism to secure the offtake agreements needed to make their projects financially viable – they are often used to predict future installation figures.

Slow permitting had previously led to tender after tender being undersubscribed in recent years, leaving onshore wind installations far short of the levels needed for Germany to meet its climate targets.

The Global Wind Energy Council (GWEC) expects Germany to account for 26% of total onshore wind additions in Europe in the next five years and continue to be the region’s market leader.

However, WindEurope believes Germany will fall short of its 115GW onshore wind target for 2030, forecasting it to reach 90GW of cumulative capacity by the end of the decade.

Despite the improvements in permitting, the country must still navigate a number of challenges in the coming years, with obstacles including inadequate road infrastructure, uneven wind farm development between north and south, and red tape for transportation, according to the BWE.

It also said that the government must be cautious when it moves to implement expected changes to Germany’s support scheme for renewables, or risk “choking off” expansion at a pivotal moment for the sector.

‘Overriding public interest’

Germany was one of the first EU member states to introduce bloc-wide measures designed to accelerate renewables permitting following Russia’s invasion of Ukraine in 2022 to replace gas imported from Russia, a WindEurope spokesman pointed out.

These included the idea of renewables being in the “overriding public interest” – meaning that when permitting bodies consider a wind farm, they must prioritise it over other objectives, such as preserving historical sites or conserving nature, with the exception of federal defence.

This approach has proven “highly effective” in advancing projects caught up in legal disputes, WindEurope added, which noted in a recent report that “projects are winning court cases they used to lose”.

The BWE spokesman suggested that this shows that “quick decision-making – in the immediate aftermath of the Russian attack on Ukraine” – can have a quick impact.

German chancellor Olaf Scholz (right), alongside finance minister Christian Lindner (left) and economy and climate action minister Robert Habeck (centre)

Chancellor Olaf Scholz’s government also updated laws to cut the timeframe for regulatory bodies to object against a renewables project – with the project considered approved if there is no complaint before the deadline.

And it fully digitalised the permitting process – meaning developers no longer need to file multiple ring binders full of paper documents when they submit their wind farms for approval – simplifying and accelerating the process.

The government has set a target of renewables supplying at least 80% of the country’s electricity consumption by 2030, which it estimates will require about 115GW of onshore wind capacity, with 10GW to be added annually from 2025.

“This government has made it very clear from the start that they want to massively expand renewable energies,” the BWE spokesman said. “We now actually see that there has been a change in the mindset on the state level. In regulation bodies, we are met with less opposition and more of a mindset that wants to achieve the expansion.”

Last year, Germany awarded new permits for 7.5GW of onshore wind projects – the second-highest annual figure on record, and the highest total for seven years – according to statistics agency FA Wind. WindEurope expects even more capacity to be approved this year.

“Germany shows that these measures can have a real impact,” the WindEurope spokesman said. “Other countries should follow the German example and quickly implement helpful measures, such as overriding public interest for renewables.”

Good on paper

But the faster approval rate is yet to translate into a boom in installations.

Germany’s net onshore wind installations totalled just 929MW in the first six months of 2024, according to statistics agency Deutsche Windguard.

Developers added 1.3GW of new wind turbines on a gross basis, but also decommissioned 379MW of capacity that was not replaced.

The slow installation rate highlights two challenges facing the German onshore wind sector.

Most of this buildout took place in the northern states of Lower Saxony, Schleswig-Holstein and North Rhine-Westphalia – a “massive problem” for multiple reasons, according to the BWE.

Energiequelle commissioned its Bad Gandersheim repowering project in Lower Saxony in April

Installations were especially slow in May and June due to the partial closure of the A27 motorway in north-west Germany – a key route for rotor blades entering the country through the port in Cuxhaven – the BWE spokesman noted.

The A27 closure highlights the need to upgrade and reinforce the country’s motorway and bridge infrastructure so that ever-larger turbine components can be transported, he added.

“These need to be put in a state where you can actually transport these very heavy and very large segments of the wind turbines. [The infrastructure is] definitely not as sturdy as it should be,” he added.

Ports – such as Cuxhaven – will also need to be expanded in the next few years to ensure they have enough capacity to store all of the blades that will be delivered, he added.

Transport tied up in red tape

Permitting is also an obstacle when it comes to transporting the components needed to build wind farms.

Transport companies require 150 permits on average to transport just one wind turbine in Germany, WindEurope noted. And there’s a backlog of 15,000 applications, which could stall installations, it warned.

The BWE spokesman explained the problem: “If you want to apply for a permit for a heavy load transport, that permit is only valid for one truck.

“So if for whatever reason, you cannot use that truck because it is damaged or stuck somewhere in traffic, then the permit is null and void.”

This leads to transport companies having to file for permits for every single truck they have, increasing time and costs, he added.

Instead, they should be able to “cluster” their permitting approvals to cut red tape and accelerate transportation, the BWE spokesman suggested.

‘A more even distribution’

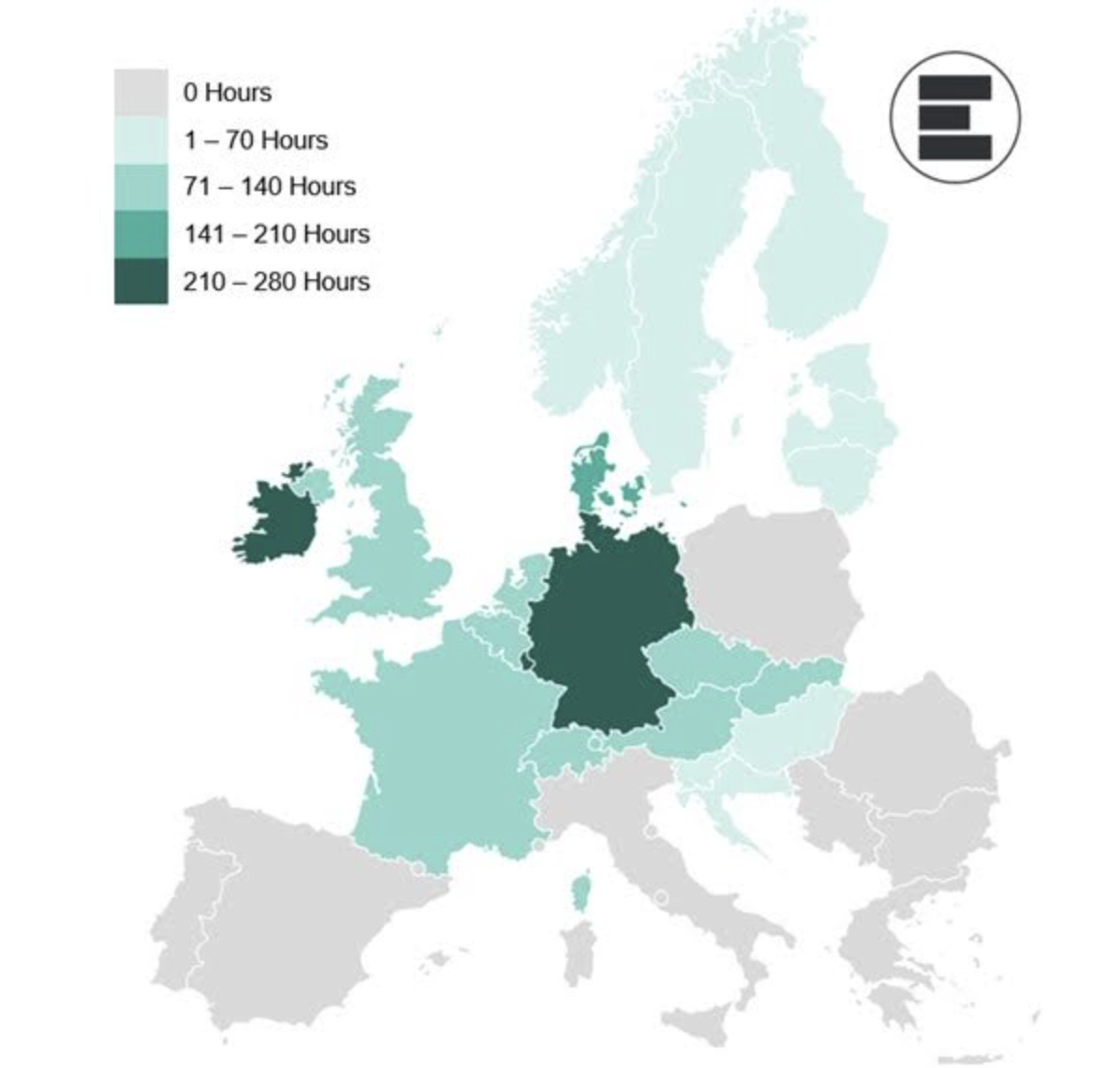

Meanwhile, the north-south divide in the recent tender results is a recurrent feature of German onshore wind – project development in northern states such North Rhine-Westphalia has long outpaced that in southern states such as Bavaria.

“A more even distribution should absolutely be the goal,” the BWE spokesman said, adding that the availability and proximity of wind farms is a “deciding factor” for energy-intensive companies such as Tesla, Northvolt and Intel – all of which have opened new factories in northern Germany in recent years – when selecting sites for their operations.

The ability to buy wind power is a crucial means for companies – however large or small – to reach their decarbonisation targets, he suggested.

Tesla CEO Elon Musk attends the opening of the company’s Gigafactory Berlin-Brandenburg in Grünheide, Germany

“Projects like the Tesla or Intel factories would have, in the past, probably gone to the south of Germany,” the spokesman said. “But this has now changed.”

The north-south divide for new wind farms also highlights the need to expand Germany’s grid to better deliver power, and make it more flexible to deliver power when it is needed, the BWE points out.

But the federal government’s enthusiasm for new renewables might now be filtering through to southern states, where wind farm development has been stubbornly difficult in the past, the spokesman suggests. This includes Bavaria, which is home to energy-intensive companies, such as car makers.

“It has been very difficult to plan projects [in Bavaria] because they’ve had very restrictive laws,” the spokesman added. “But the [ultra-conservative] Bavarian government has loosened its grip on some of these aspects, and that’s a very recent development.”

Avoid ‘gross mistakes’

However, industry groups are concerned that planned changes to Germany’s support scheme for renewables could derail growth at a crucial juncture.

The government plans to reform the current subsidy scheme, according to statements issued ahead of next year’s budget. Although a number of alternative models have been proposed – including contracts for difference (CfDs) and government support for capital investments in new clean energy projects – it is as yet unclear how the system will change.

Industry groups have urged Berlin to avoid making drastic changes.

The BWE spokesman called for a “level-headed change that is thought through to the end and not abrupt”.

Project developers tend to rely heavily on bank loans to fund their wind farms – often for as much as 90% of the initial outlay – so sudden changes to financing would be a “gross mistake”, he warned.

“If you suddenly change the conditions [in which projects are planned], you actually risk choking off the expansion of renewable energies at a time when we finally see the trajectory and the uptick that we’ve been waiting for,” he added.

“We are currently at a crucial point of renewables expansion, and we need security for planning and for financing if we want to secure the current positive trend that we’re seeing.”