Enviva reports progress with development of Epes, Bond facilities

Energy Disrupter

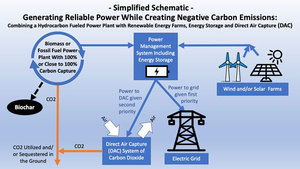

ADVERTISEMENT

Enviva Inc. released first quarter financial results on April 3, reporting that construction is progressing well at its wood pellet plant in Epes, Alabama. Construction is also expected to start on its proposed facility in Bond, Mississippi, later this year. Delivered volumes of wood pellets were up 20 percent during the three-month period, and Enviva has announced a new take-or-pay contract with an existing Japanese customer.

Enviva delivered approximately 1.3 million metric tons of wood pellets during the first quarter of this year, up 20 percent when compared to the same period of 2022. Delivered volumes, however, fell short of management’s expectations of 1.5 million metric tons. Delivered at port cost per metric ton declined by $9 throughout the first quarter but remained higher than management’s expectations.

The company reported it has signed a new 10-year take-or-pay contract with an existing Japanese counterparty for deliveries of approximately 300,000 metric tons per year of wood pellets. Deliveries are expected to commence in tandem with new capacity coming online, according to Enviva.

The Epes facility is expected to become operational in mid-2024. Enviva secured a revised permit for the facility in March. The facility is expected to have a nameplate capacity of 1.1 million metric tons per year.

Enviva is also progressing on the development of its 12th wood pellet facility, which will be located near Bond, Mississippi. The company said it is moving forward with its process to enter construction agreements with one or more EPC firms to complete the engineering, procurement and construction of the facility. Enviva has secured all the necessary permits for the plant and is expected to have a signed EPC agreement in the second half of 2023. That facility could be placed in service by the fourth quarter of 2024, approximately six months earlier than originally planned. Given the strong pace of contracting, Enviva also reported that it potentially has the option to accelerate the timing of two additional greenfield developments with potential in-service dates in late 2025 and late 2026, respectively.

In the company’s first quarter report, John Keppler, executive chairman of the board, discussed plans and initiatives underway to improve productivity and costs across the company’s current asset platform, which he said continue to fall behind expectations. “While the board of directors remains convinced of management’s ability to deliver the originally forecasted operational and financial performance over time, it is clearly taking longer than expected,” Keppler said. “To more conservatively underwrite that plan and ensure the ability of the Company to capture the value of the fully contracted growth ahead, after careful consideration with management, the board of directors evaluated the most accretive uses of the Company’s capital and decided to revise Enviva’s capital allocation framework, eliminating the Company’s quarterly dividend in order to preserve liquidity and a conservative leverage profile, maintain our current growth trajectory, potentially accelerate future investments in new fully contracted plant and port assets, and implement a limited share repurchase program.”

“We recognize this is an important departure from the plan we laid out at our Investor Day a month ago, but a lot has changed since then,” said Thomas Meth, president and CEO of Enviva. “Compared to our expectations, while our cost position has trended in the right direction, it has done so at a much slower pace than we had anticipated, in part due to slower volume growth, and in part due to a higher spend profile for the volume growth we did achieve.”

“We know what the specific issues are: contract labor is too high, discipline around repairs and maintenance spend is insufficient, wood input costs need to come down further and stay there, and utilization rates at specific plants need to improve and stabilize at those improved levels,” he added. “Because of where we are in our journey to bend our cost curve down while bending our production curve up, we feel it is prudent to take a much more conservative view of what our business can realistically achieve over the next eight months.”

“Against this backdrop of operational challenges, we are undergoing an extensive review of where we are allocating our capital,” Meth continued. “We believe we have more accretive capital allocation alternatives, which start with improving returns from our existing fleet of assets, growing our fully contracted asset base, managing liquidity and leverage, and also include the potential to opportunistically repurchase our shares in the open market, which we believe have traded below their intrinsic value for some time.”

Enviva reported a net loss of $116.9 million for the first quarter of 2023, compared to a net loss of $45.3 million during the same quarter of last year. EBITDA was $3.4 million, compared to $36.6 million.