Enviva: Epes plant on track to begin operations in 2024

Energy Disrupter

ADVERTISEMENT

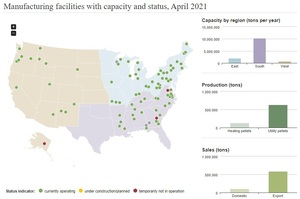

Enviva Inc. on Aug. 3 announced that construction on its Epes wood pellet plant in Alabama is progressing well, with the plant scheduled to be operational next year. The company may, however, delay the in-service date of its Bond, Mississippi, project by six to 12 months. The company discussed the development of these projects in its second quarter financial report.

According to the report, the Epes plant is expected to be operational in mid-2024. The facility will have a nameplate capacity of 1.1 million metric tons per year. In addition to Epes, Enviva said it is moving forward with its process to enter into construction agreements with one or more EPC firms to complete the engineering, procurement and construction of its proposed Bond plant and future similar plants. “WE have all the necessary permits in hand for our Bond development, and expect to have a signed EPC agreement during the fourth-quarter 2023,” Enviva said in a statement.

“Because Enviva’s top financial priority is effectively managing liquidity and leverage to achieve our targets, we are monitoring the progress we make with the cost profile and improving production rates of our existing asset fleet,” Enviva continued. “To the extent we are not on pace with reaching our targets, we have the opportunity to defer the build timing of Bond and move the in-service date back by approximately six to twelve months without impacting customer commitments, thus enhancing our near-term liquidity and leverage profile, and potentially reducing the likelihood of needing to access capital markets to fund Bond. This deferral of Bond timing would move the planned in-service date from mid-2025 into 2026.”

Enviva also noted it has submitted applications for both the Epes and Bond plants related to the Qualifying Advanced Energy Project Credit (48C) Program. The 48C program provides an investment tax credit (ITC) of up to 30 percent of qualified investments. Enviva said it expects to be notified in the coming months as to the likelihood of receiving such tax credits.

Regarding operations at its existing wood pellet plants, Enviva said it sold 1.302 million metric tons of wood pellets during the second quarter, up 2 percent when compared to the same period of last year. According to the company, second quarter volumes benefitted from fully ramped production at its Lucedale, Mississippi, plant. Volumes, however, were negatively impacted by a scheduled extended outage at the plant in Waycross, Georgia, and a shutdown of the Amory, Mississippi, plant in March due to tornado damage. The Waycross outage was completed in April and May and the facility resumed operations in June. Operations at the Amory plant are expected to resume by October.

Enviva said it began operating its Southampton, Virginia, plant at half its nameplate capacity late in the second quarter while the company retrofits an underperforming dryer line. That facility has been operating profitably for the past several quarters, according to Enviva, but is expected to operate on a financial breakeven basis during the second half of this year. The company said it is evaluating options to make the plant profitable on a go-forward basis.

Small manufacturing process changes were made to the Greenwood, South Carolina, plant during the second quarter. Enviva said these changes raised production rates at the facility. The Greenwood facility also changed its fiber procurement strategy to include more hardwood purchases. Enviva said these changes improved the cost position of the facility. As a result, Greenwood is on a path to reach its target production level and cost position during the fourth quarter of this year.

Within its second quarter report, Enviva also announced its first sales into the emerging biomass market in Poland. The company sold two test shipments for consumption in Poland that are scheduled to be loaded during the third quarter of 2023.

Gross margin for the second quarter was $10.4 million, down from $16.8 million during the same period of last year. Enviva primarily attributed the decrease in gross margin to higher shipping costs due to more delivers into Japan. Those impacts were partially offset by improvements in fiber costs and plant-level operating costs. Gross margin per metric ton was $8.02 during the second quarter, down from $13.19 during the same quarter of 2022. Adjusted EBITDA was $26 million, down from $39.5 million.

A full copy of Enviva’s second quarter report is available on the company’s website.