FutureMetrics: Inflation Reduction Act incentivizes BECSS

Energy Disrupter

ADVERTISEMENT

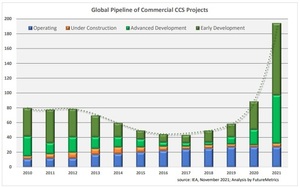

FutureMetrics LLC on Aug. 29 published a white paper that explains how the Inflation Reduction Act, signed by President Biden on Aug. 16, could support the implementation of bioenergy with carbon capture and storage (BECSS) in the U.S.

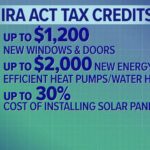

The paper, authored by FutureMetrics President William Strauss, explains that one provision of the IRA extends and modifies the 45Q tax credit for carbon sequestration. Under the new law, any new carbon capture and storage (CCS) facility build within the next decade that permanently stores carbon dioxide will receive $85 per U.S. short ton ($95.50 per metric ton) for each ton of carbon dioxide sequestered.

According to Strauss, the expanded 45Q tax credit could incentivize the use of wood pellets at U.S. coal-fired facilities as part of carbon-negative BECCS projects. “Sequestration of CO2 from the combustion of sustainably sourced biomass derived fuel is the only pathway to negative CO2 emissions while producing baseline or on-demand load-following power,” Strauss wrote. “Carbon negative bioenergy carbon capture and sequestration (BECCS) is how the IRA opens the door for pellet fuel use in U.S. coal-fueled utility power plants.”

Within the paper, Strauss goes on to explain that BECCS “is orders of magnitude more efficient and economical” than direct air capture (DAC) technologies, which capture carbon dioxide from ambient air as part of a CCS system. Strauss also identifies numerous existing U.S. coal assets that could be strong candidates for the implementation of BECCS. An accompanying dashboard focused on the implementation of BECSS at 27 of these assets is also available.

A full copy of the white paper and link to the interactive dashboard is available on the FutureMetrics website.