House passes Inflation Reduction Act

Energy Disrupter

ADVERTISEMENT

The U.S. House of Representatives on Aug. 12 voted 220 to 207 to pass the Inflation Reduction Act of 2022, a legislative package that includes a wide range of provisions that benefit the biofuel and bioenergy industries. President Biden is expected to sign the bill next week.

The bill, in part, establishes new tax credits for sustainable aviation fuel (SAF), clean transportation fuels and clean hydrogen. It also extends several existing tax credits that benefit transportation biofuels, such as renewable diesel and biodiesel, and includes funding for biofuel infrastructure development. Other provisions of the bill support the production of biogas- and biomass-based electricity and offer tax incentives for homeowners to install biomass-fired residential heating appliances. The bill also extends and expands the Section 45Q tax credit for carbon capture and storage (CCS).

The new SAF tax credit supports the sale and use of the fuel. The credit starts at $1.25 per gallon for SAF that achieves a 50 percent greenhouse gas (GHG) reduction when compared to a baseline fossil fuel. An additional 1 cent per gallon is available for each percentage point by which the lifecycle GHG emission reduction of the fuel exceeds 50 percent. The tax credit is capped at $1.75 per gallon.

Also in support of SAF, the legislation aims to establish a competitive grant program in support of alternative aviation fuels and low-emission aviation technologies. In part, the program would provide grants to eligible entities to carry out projects located in the U.S. that produce, transport, blend or store SAF. Nearly $250 million in funding would be available to support SAF projects under the program.

A separate provision in the bill creates a new Clean Fuel Production Tax Credit. The technology-neutral tax credit aims to support the production of low-emissions transportation fuel and would apply to transportation fuel produced and sold in 2025, 2026 and 2027. To qualify, the fuel would have to achieve a GHG reduction of approximately 40 percent when compared to diesel.

In addition, the bill creates a new Section 45V production tax credit (PTC) for clean hydrogen produced at qualified facilities that begin construction before the end of 2032. The credit would apply to hydrogen produced after the end of 2022. Depending on the specific project, the credit could range from 12 cents per kilogram to $3 per kilogram, according to the bill text.

The bill also extends several existing bioenergy and biofuel tax credits. The $1 per gallon blends tax credit for biodiesel and renewable diesel is extended through the end of 2024. It also extends the 50-cent per gallon alternative fuels tax credit, the second-generation biofuel income tax credit, and the alternative fuel vehicle refueling property credit.

In addition, the legislation appropriates $500 million to support the development of biofuel infrastructure, including infrastructure improvements for blending, storing, supplying or distributing biofuels; installing, retrofitting or upgrading fuel dispensers to supply higher blends of biofuels; and for building and retrofitting home heating oil distribution centers to supply biofuels. It also includes an estimated $18 billion in support of climate-smart agriculture, which will benefit biofuel producers through the production of lower-carbon feedstocks.

For renewable electricity, the bill extends the Section 45 production tax credit (PTC), which benefits qualified biogas, open-loop biomass and closed-loop biomass facilities, to qualified facilities that begin construction before Jan. 1, 2025. For home heating, the bill extends and modifies of the Section 25 tax credit, which, in part, supports the installation residential biomass-fired stove and boilers. The tax credit for these residential appliances is capped at $2,000.

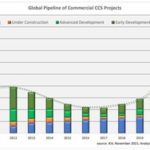

The bill supports CCS projects through an extension and modification of the Section 45Q tax credit. The legislation extends the Section 45Q tax credit to any carbon capture, direct air capture or carbon utilization project that begins construction before Jan. 1, 2033. It also increases the value of the credit for industrial facilities and power plants that capture their carbon emissions to $85 per metric ton of CO2 stored in secure geologic formations, $60 per ton for the beneficial utilization of captured carbon emissions, and $60 per ton for CO2 stored in oil and gas fields. For direct air capture technologies, the credit is increased to $180 per metric ton for projects that store captured CO2 in secure geologic formations, $130 per ton for carbon utilization, and $130 per ton for CO2 stored in oil and gas fields.

Representatives of the biofuels and bioenergy industries are applauding the Inflation Reduction Act’s support of biobased fuels and energy.

The Advanced Biofuels Association is commending the House for passing the bill, stressing it will help achieve meaningful carbon reductions in the U.S. “Congress passing the IRA is a significant step toward achieving President Biden’s national climate ambitions,” said Michael McAdams, president of the ABFA. “It is undoubtedly the single largest law Congress has ever enacted to combat climate change.

“This comprehensive bill offers a suite of meaningful policy directives that will enable the advanced biofuels industry to better reach its fullest potential, including long-term tax policy, new financing and grant resources at DOE, USDA, and DOT, and increased federal resources for EPA to administer the Renewable Fuel Standard,” he continued. “We support all of these provisions. Together, they comprise the integrated strategy necessary to achieve meaningful carbon reductions in the United States.

“Yet, ABFA will not be resting on our laurels,” McAdams added. “There is still much work to be done to ensure that low carbon industries reach their fullest emissions reductions potential. We look forward to engaging with the EPA about upcoming Renewable Volume Obligations rulings and related issues, such as feedstock supply and emerging technologies, to ensure a cleaner, more sustainable future for all.”

The American Coalition for Ethanol is stressing that the climate and biofuel provisions in the bill will expand ethanol use. “This far-reaching legislation Congress sent to the President’s desk will provide half a billion dollars for E15 and E85 infrastructure, invest a whopping $18 billion to support climate-smart agriculture practices which help reduce the carbon intensity of ethanol, reward fuels like ethanol with a new clean fuel production tax credit based on carbon intensity, establish a new sustainable aviation fuel tax credit based on carbon intensity, and give a big boost to projects which capture and sequester carbon,” said Brian Jennings, CEO of ACE.

“While this bill does not contain everything on our wish list, it does contain some incredible incentives for farmers and ethanol producers looking to capitalize on carbon intensity and we encourage the President to sign it into law, so farmers and ethanol producers can continue innovating and playing a meaningful role in helping combat climate change,” Jennings added.

The Renewable Fuels Association said the biofuel provisions of the bill will stimulate growth and investment in the use of low-carbon renewable fuels like ethanol. “We are pleased that both houses of Congress have now recognized the important role renewable fuels like ethanol can play in bolstering our nation’s economy and accelerating decarbonization efforts,” said Geoff Cooper, president and CEO of the RFA. “When it comes to ethanol and other renewable fuels, this bill represents the most significant federal commitment to low-carbon biofuels since the Renewable Fuel Standard was expanded by Congress in 2007. We look forward to these provisions becoming law quickly so that American families have greater access to lower-cost, American-made renewable fuels that are good for the environment, the economy, and energy security.”

The American Biogas Council is applauding the bill, calling it a historic investment in clean energy. “Today is a monumental day for clean energy production and the U.S. biogas industry. Congress has recognized the essential role biogas systems, which recycle organic waste into renewable energy and domestic, natural fertilizer products, play in our society,” said the group in a statement. “With only two ways to recycle the billions of tons of organic waste the U.S. produces every year, biogas systems and compost systems, we can’t accelerate construction of this essential infrastructure fast enough. The IRA will help us push the pedal down.

“Before this bill, our industry had only benefitted from short one- to two-year extensions of a tax credit that served one sector of the biogas industry,” the ABC continued. “While trying to attract investment to projects that take years to build and competing with other industries with long-term tax credits, this was not a long-term solution. For the first time, this bill gives developers and financiers certainty and a competitive edge that will fuel growth of the biogas and clean energy industries for years to come.”

Clean Fuels Alliance America said the legislation will support the continued growth of biodiesel, renewable diesel and SAF. “Cleaner, better fuels like biodiesel and renewable diesel are essential to America’s economy and environment. They support good-paying jobs, reduce fuel prices and the cost of transporting consumer goods, and cut carbon emissions by an average 74 percent,” said Kurt Kovarik, vice president of federal affairs at Clean Fuels. “We appreciate Congress providing our industry long-term certainty in tax policy, and we thank Representatives Cindy Axne and Angie Craig for their tireless advocacy of the biodiesel tax credit, as well as Chairman Richard Neal and Representative Mike Thompson for supporting its inclusion in today’s legislation.”

“We applaud the new Biofuel Infrastructure and Agriculture Product Market Expansion, which will build on the success of USDA’s current infrastructure grant program,” Kovarik continued. “As our industry looks to continue growing and sustainably meeting America’s need for affordable, clean energy, these grants will help our industry deliver cleaner, better fuels directly to consumers.”