How the Inflation Reduction’s Solar Tax Credit Works – Consumer Reports

Energy Disrupter

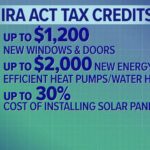

This credit, now named the Energy Efficient Home Improvement Credit, has dollar caps for some products—for example, $600 on windows. For most items, however, you can claim 30 percent of the cost up to $1,200 total annually. (Heat pumps are exempt from the per-item or per-year maximums; you can claim up to $2,000 for heat-pump purchase and installation costs.)

A big plus: You can claim the Nonbusiness Energy Property Credit every tax year through 2032. In the past, taxpayers who exceeded “lifetime limits” for qualifying home improvements under that provision couldn’t claim the credit for later improvements.

In theory, that means you could install one or two new Energy Star certified windows each year, and qualify toward the $1,200 credit. “That might be irritating to your window supplier and fairly inconvenient for you,” says Mark Luscombe, principal analyst at Wolters Kluwer Tax & Accounting, a financial publisher. “But you could do it.”

Original Source: https://www.consumerreports.org/home-garden/alternative-energy/how-the-residential-clean-energy-solar-tax-credit-works-a1771685058/