Turbine order recovery continues in Q3 following Covid-19 slump

Energy Disrupter

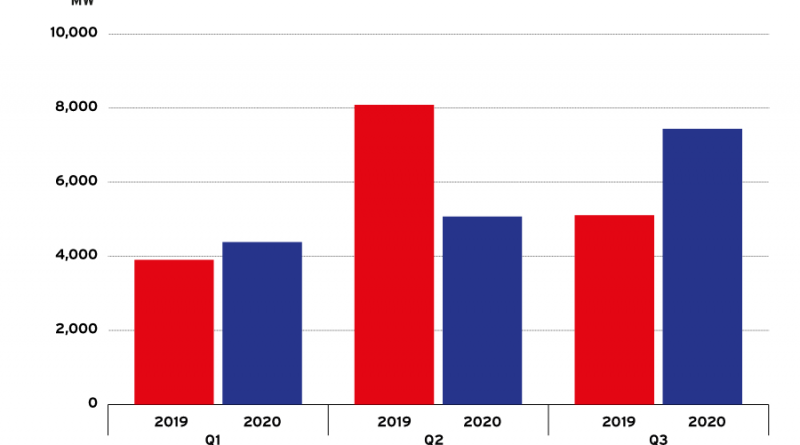

The apparent recovery of turbine purchasing that began in June continued through the summer, with the third-quarter total recorded by Windpower Intelligence up significantly — not only from the preceding three months, but also on the corresponding period one year ago.

The top five western manufacturers – Vestas, Siemens Gamesa, Nordex, GE and Enercon – reported firm onshore orders of just over 7.4GW in 28 countries in Q3, according to Windpower Intelligence, the research and data division of Windpower Monthly.

This combined capacity was up from 5,070MW recorded in the preceding quarter and 5,103MW in Q3 2019.

The continued recovery follows an apparent slump in reported turbine purchase agreements (TPAs) in the spring, before business started picking up again by the end of June.

Analysts had suggested that cancelled trade events and company travel bans amid the coronavirus pandemic could have weakened transaction volumes in the first half of the year.

But provisional Windpower Intelligence data for the July-September quarter appear to suggest that this downturn has now passed.

Global picture

The five western OEMs announced firm onshore orders in 28 countries in the third quarter – three more destinations than were recorded in the first half of the year, and eight more than in Q3 2019.

With 1.77GW of orders, the United States was the primary market in the third quarter of 2020, followed by the UK (480.8MW), India (473MW) and Brazil (436.7MW).

There was also a number of large orders in Egypt, Russia, Pakistan, Morocco and Colombia in Q3, and more than 1GW of orders were recorded in emerging markets last month.

Windpower Intelligence recorded 350MW of orders from China in Q3 2020, but this figure is likely to be higher as Chinese manufacturers’ orders were excluded from the provisional data as not enough information is available.

Several markets experienced an acceleration of orders between Q2 and Q3, while others experienced a downturn.

Market share

All five OEMs recorded more firm, onshore turbine deals in Q3 2020 than they had a year earlier and in the second quarter of 2020.

Vestas’ 3452.4MW tally placed it in pole position. It was followed by Siemens Gamesa (1,629MW), Nordex (1,137.1MW), GE (1,041.9MW) and Enercon (432.6MW). The Danish manufacturer also had the largest market share in the first half of the year, at 52%

Meanwhile, Siemens Gamesa and Enercon recorded more orders in Q3 20 than they did in the first six months of the year combined.

SGRE recorded large orders in Pakistan (260MW), India (473MW), the US (325MW) and Morocco (301MW), while Enercon picked up big orders in Austria (212MW) and Germany (220.6MW) after a quiet first six months of the year.