FutureMetrics calls roundwood restrictions for pellets misguided

Energy Disrupter

ADVERTISEMENT

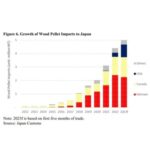

Some European Union policymakers are calling for a restriction on the use of roundwood as feedstock for wood pellet production. FutureMetrics LLC on June 25 published a white paper explaining why those efforts are misguided.

“While the spirit of the policymaking exercise is properly grounded as a tactic to disallow deforestation and encourage the most efficient use of a renewing resource, a blanket exclusion of ‘roundwood’ is misguided,” wrote FutureMetrics President William Strauss in the paper.

Strauss stresses that there is no place for permanent deforestation in the forest products industry. “The foundational and absolutely necessary condition that underpins the definition of wood as a renewable resource is that the stock of trees in a managed forest must remain constant or growing,” he wrote.

Maintaining a constant or growing stock of trees in a managed forest is good for both the environment and business, Strauss explains. Pellet mills and other facilities that process forest biomass reply on a constant flow of logs and chips, matching their annual feedstock demand to the ability of the regional managed forests to supply wood is essential to the business model. “It would make no sense for the investors of hundreds of millions of dollars to expect to deplete the project’s essential raw material and face cost pressure due to increasing scarcity and risk financial failure,” Strauss continued. “Wood pellet exporters operate under these same constraints and have the added oversight of having to have independent certification that their raw material sources are sustainably managed.”

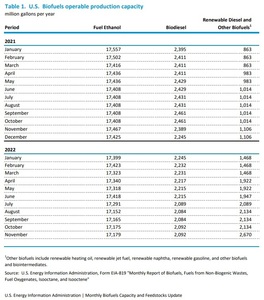

Strauss estimates that North American pellet mills that produce pellets for export accounted for approximately 4.9 percent of wood demand in 2021. Much of that wood, however, is byproduct material produced by other wood product sectors, such as those that produce lumber, flooring, furniture or pulp and paper. In fact, Strauss explains that sawmilling byproducts in North America likely exceed 80 million metric tons per year.

North American pellet mills take in an estimated 26.6 million metric tons of wood, but roundwood accounts for a relatively small percentage of that volume. According to Strauss, the roundwood that is processed by pellet mills in the residuals from the harvests that are unsuitable to higher value use or are not marketable in the region of the harvest. He explains that the highest value of any newly harvested tree is the sawlog portion. “The working forest’s landowner has every incentive to maximize their profit from the harvest by maximizing the production of sawlogs,” Strauss wrote. “Using sawlogs for purposes other than making lumber almost never happens.”

Lower value material is used to make paper, cardboard, and other products. Of all the potential users of that lower value byproduct, pellet producers have the most restricted ability to pay, according to Strauss. “Bottom line is that pellet mills are bottom feeders,” he wrote. “They take what is left over that no one else wants.”

“To suggest that all roundwood be excluded from pellet feedstock entirely misses the dynamics of how forests are managed, the costs of transporting roundwood longer distances, and how the different parts of a tree can be used for different products,” Strauss wrote.

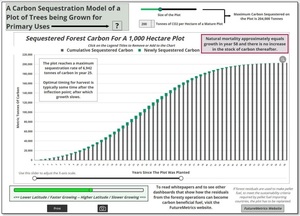

Regarding concerns over carbon sequestration by forests, Strauss notes that leaving forests untouched isn’t an effective strategy. Forests do not continue to soak up carbon forever, he wrote. At some point a forest will reach growth equilibrium where the mortality rate will equal the growth rate and the quantity of wood—and sequestered carbon—will reach a limit.

A full copy of the white paper and an accompanying dashboard is available on the FutureMetrics website.