Residential Energy Credits for Homeowners – The Military Wallet

Energy Disrupter

In order to deduct mortgage interest and real estate taxes on a tax return, a taxpayer needs to benefit from itemizing more than they would benefit from the standard deduction. Most homeowners benefit from the standard deduction more than itemizing, so owning a home turns out not to lower taxes.

But there is another way to save on taxes as a homeowner: Residential energy credits. These energy credits allow homeowners to reduce their taxes while improving their primary homes through energy efficiency updates. The Inflation Reduction Act will improve these credits, especially in the 2023 tax year. Remember, the tax credits apply to the year the improvement project is completed.

Residential Energy Credits 2023

There are two categories of energy credits. The first is qualified clean energy credits, also known as residential clean energy credits. These credits are for improvements like solar panels, fuel cells, solar hot water systems, geothermal, and wind systems. Any systems purchased and installed from January 1, 2023, through 2033 qualify for a 30% credit.

The second category is nonbusiness energy property credit. Unfortunately, this credit has a homeowner’s lifetime limit of $500. However, it does apply to certain energy-efficient improvements and energy property expenditures homeowners are more likely to take on.

Energy-efficient improvements include updates such as insulation, certain metal roofing, exterior windows, and exterior doors.

Qualified energy property includes updates like heat pumps, heat pump water heaters, and HVAC systems.

Keep in mind the credit you actually receive depends on the specific qualifying items. For example, you get different amounts for windows versus insulation. Additionally, the items qualifying for this credit are typically required to have certain efficiency or energy ratings. You can find more details on this credit in IRS Form 5695.

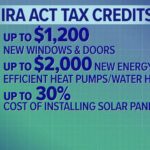

The Energy Efficient Home Energy Credit

The nonbusiness energy credit becomes the energy-efficient home energy credit starting in the tax year 2023. The credit is now worth 30% of expenditures but with an annual limit. The limit for improvements like energy-efficient insulation and exterior doors and windows will be an annual limit of $1200. There is a limit of $2000 for property improvements like heat pumps, heat pump water heaters, and biomass systems and boilers.

Again, like the nonbusiness energy credit, these limits are further limited for specific items. For example, the max annual credit limit for a central air conditioner is $600. To qualify, the improvements have to meet certain efficiency or energy standards. Overall, there are more items and improvements covered under the credit change going forward.

Efficiency Credits for Low to Moderate-Income Households

The High Efficiency Electric Home Rebate Act (HEEHRA) was passed within the Inflation Reduction Act and goes into effect in 2023. If a household has less than 80% of the Area Median Income (AMI) the household may qualify for a 100% rebate. Alternatively, if a household has 80 to 150% of AMI, they may qualify for 50% rebates.

The US Department of Housing and Urban Development (HUD) determines AMI. These rebates are for use in a primary residence to improve energy efficiency and may include wiring and appliances as well as many of the improvements covered by the tax credits mentioned above. Note that you won’t be able to double dip, using the tax credit and the rebate for the same expenditures.

The Bottom Line on Residential Energy Credits

Don’t go out and spend money on home improvements just because you may get credits. Do your research and the math to make sure the investment makes sense for you. If it doesn’t make sense without the credit, it may not make sense with the credit.

Often, doing improvements “in bulk” can help reduce overall costs. You may want to do the math to determine if you’ll come out ahead by spreading out the improvements over multiple years and getting more in total tax credits.

About Post Author

Original Source: https://news.google.com/__i/rss/rd/articles/CBMiOWh0dHBzOi8vdGhlbWlsaXRhcnl3YWxsZXQuY29tL3Jlc2lkZW50aWFsLWVuZXJneS1jcmVkaXRzL9IBAA?oc=5