New tax credits and rebates available to help lower energy bills and … – What’sUpNewp

Energy Disrupter

U.S. Senator Sheldon Whitehouse joined Rhode Island Energy and labor officials to encourage Rhode Island residents to take advantage of new home energy tax credits and rebates that went into effect on January 1.

The credits and rebates are part of the Democrats’ Inflation Reduction Act and can provide significant savings on energy-efficient home improvements, helping families save money on their utility bills and reduce their carbon footprint.

The Act provides up to 30 percent in tax credits for energy-efficient home improvements, rebates for residential efficiency retrofits and electrification projects, and up to 30 percent in tax credits for rooftop solar, batteries, and geothermal heat pumps.

The Act is expected to create millions of jobs and reduce emissions by up to 40 percent over the next decade. It also includes provisions for using American-made equipment for clean energy production and expanded clean energy tax credits for utility-scale wind, solar, nuclear, clean hydrogen, and carbon capture.

Whitehouse’s constituent services staff is available to help Rhode Islanders navigate the new programs at 401-453-5294.

Read More

Whitehouse Encourages Rhode Islanders to Take Advantage of New Tax Credits and Rebates to Lower Energy Bills and Green Up Homes

Whitehouse helped shape new home energy tax credits as a member of the Senate Finance Committee

Cranston, RI – U.S. Senator Sheldon Whitehouse today joined with labor officials and representatives of Rhode Island Energy to encourage Rhode Islanders to take advantage of the new energy-efficient and clean energy home improvement tax credits now available thanks to Democrats’ Inflation Reduction Act. The tax credits and rebates, which went into effect on January 1, can provide major savings on energy-efficient home improvements that will help families save money on utility bills.

“Our Inflation Reduction Act includes tons of savings for working families,” said Whitehouse, who helped shape the home energy tax credits in the Inflation Reduction Act as a member of the Senate Finance Committee. “For starters, Rhode Islanders who want to make their home more energy efficient can get a lot of their investment back in the form of tax credits and rebates. Families will save money on their utility bills while doing their part to fight climate change.”

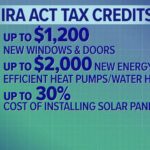

The new programs provide:

- Up to 30 percent in tax credits for energy-efficient home improvements (e.g., insulation, windows, and doors)– generally capped at $1,200 per year, but potentially up to $3,200 if improvements include heat pumps, heat pump water heaters, or biomass stoves;

- Rebates for residential efficiency retrofits, electrification projects including heat pumps, cooktops, and other appliances, as well as associated electrical upgrades;

- Up to 30 percent in tax credits for rooftop solar, batteries, and geothermal heat pumps, including certain installation costs.

More information on the new credits and rebates available for specific appliances and services is available here. The Inflation Reduction Act puts the U.S. on track to reduce emissions by up to 40 percent over the next decade.

“Thanks to the leadership of Senator Whitehouse and Rhode Island’s Congressional Delegation, the federal resources provided through the IRA will be a critical asset in helping our state meet it’s clean energy goals,” said Dave Bonenberger, President of Rhode Island Energy. “These tools will help some of our most vulnerable customers take steps to reduce energy consumption and costs and provide new opportunities for homeowners and businesses to further decrease their carbon footprint. We’re excited to help put this legislation to work for Rhode Island and continue advancing our shared clean energy goals for the state.”

The Inflation Reduction Act is expected to create millions of jobs over the next decade. The law established Make it in America provisions for the use of American-made equipment for clean energy production. The legislation provides expanded clean energy tax credits for utility-scale wind, solar, nuclear, clean hydrogen, and carbon capture, including bonus credits for businesses that pay workers a prevailing wage and use registered apprenticeship programs.

“The Inflation Reduction Act is a truly transformational piece of legislation, and in time will be spoken about in the same conversation with FDR’s New Deal and LBJ’s Great Society. The tax credits and rebates to help everyday Rhode Islanders go green at home will work to ensure we establish a just transition to a carbon-free economy all while employing highly skilled union members, like the members of IBEW Local 99, as part of the transition. Thank you to Senator Whitehouse for his continued leadership on these issues,” said Patrick Crowley, Secretary-Treasurer of the Rhode Island AFL-CIO and co-chair of Climate Jobs Rhode Island.

“The Inflation Reduction Act is another blockbuster accomplishment of the Biden administration and a remarkable win for the American people. Every part of this legislation improves the lives of our families, friends and neighbors by making every day more affordable at a time when we need it most. One of the most critical sections of the Inflation Reduction Act, in my belief, is the investment in protecting our climate, reducing household energy costs and working towards a cleaner path of powering our great Nation. I laud the determination of our elected leaders who share the vision of a better way of life for their constituents and never lost focus on this most important goal,” said Joseph L. Walsh, Jr., Business Manager for IBEW Local Union 99.

Whitehouse’s constituent services staff is available to help Rhode Islanders navigate the new programs at 401-453-5294.