USDA maintains forecast for 2022-’23 soybean oil use in biofuels

Energy Disrupter

ADVERTISEMENT

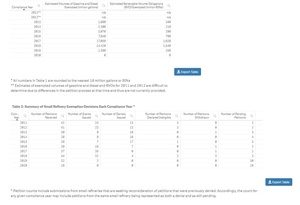

The USDA reduced its estimate for 2021-’22 soybean oil use in biofuel by 200 million pounds in its latest World Agricultural Supply and Demand Estimates report, released Aug. 12. The forecast for 2020-’23 soybean oil use in biofuel was maintained.

The agency’s 2022-’23 outlook for soybeans is for higher beginning stocks, production, exports and ending stocks. Beginning soybean stocks are raised on lower 2021-’22 exports. Soybean production for 2022-’23 is forecast at 4.53 billion bushels, up 26 million with higher yields more than offsetting lower harvested area. Harvested area is forecast at 87.2 million acres, down 300,000 from July. The first survey-based soybean yield forecast of 51.9 bushels per acre is raised 0.4 bushels from last month. Soybean supplies for 2022-’23 are projected at 4.8 billion bushels, up 36 million from last month. U.S. soybean exports are raised 20 million bushels to 2.16 billion on increases supplies. Soybean ending stocks are forecast at 245 million bushels, up 15 million.

The USDA currently predicts 12 billion pounds of soybean oil will go to biofuel production for 2023-’22, a forecast maintained from the July WASDE. The agency now estimates 10.5 billion pounds of soybean oil will go to biofuel production in 2021-’22, down 200 million pounds when compared to the 10.7-billion-pound forecast made in July. Approximately 8.85 billion pounds of soybean oil went to biofuel production in 2020-’21.

The U.S. season-average soybean price for 2022-’23 is forecast at $14.35 per bushel, down 5 cents from last month. Soybean meal and oil price forecasts are unchanged at $390 per short ton and 69 cents per pound, respectively.

The 2022-‘23 global oilseed supply and use forecasts include higher production, crush, exports, and ending stocks compared to last month. Global oilseed production is raised 2.9 million tons to 646 million with higher forecasts for soybeans, rapeseed, and sunflower seed partly offset with lower cottonseed production in the U.S. In addition to higher production for the U.S., soybean production for China is increased on higher area cited in recent provincial reports. Australia’s canola crop is raised 700,000 tons to 6.1 million on higher yields resulting from favorable weather conditions. Russia’s rapeseed crop is forecasted at a record 3.9 million tons, up 1.1 million from the previous forecast on sharply higher area. Russia’s sunflower seed production is raised 1.5 million tons to 17 million, also on higher reported area. Sunflower seed production is reduced for the EU and South Africa. Lower EU production reflects hot, dry conditions in July.

Global 2022-‘23 oilseed crush is raised on higher soybean crush for Brazil and higher rapeseed and sunflower seed crush for Russia. With increased supplies, rapeseed exports are raised for Australia and Russia. Global rapeseed exports are also raised with the addition of Uruguay to global supply and demand estimates. Sunflower seed imports are raised for the EU and Belarus paired with increased exports for Russia and Ukraine. Global oilseed stocks are raised with higher soybean and rapeseed stocks partly offset with lower sunflower seed stocks.