U.S. South Pulpwood Supplies and Echoes of the Great Recession

Energy Disrupter

Though having ended over a decade ago, the Great Recession continues to affect the forest industry.

ADVERTISEMENT

Part of understanding the current market situation and then taking a position on how things could turn out in the future depends on evaluating history and how we got here in the first place. Dr. Shawn Baker, Forisk’s vice president of research, recently evaluated the current high pulpwood prices in the U.S. South within the context of forest supplies since the Great Recession 14 years ago. While forest rotations last decades, the effects of that major economic downturn can be seen in the forest and felt in the market to this day.

While it may seem arbitrary to reflect on the Great Recession today, we revisit this timeframe because, according to our most recent southern silviculture survey, 14 years is the average age of a first thinning on intensively managed southern pine plantations. This begs the question of how echoes of the Recession may reverberate today across pulpwood markets.

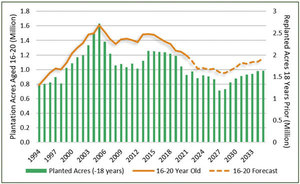

Reduced sawtimber harvests during and following the Great Recession led to fewer replanted acres. Data and analysis from Forisk and the USDA Forest Service suggest that the acres of pine plantations available for first thinnings and the associated pulpwood supplies could be reduced for a decade or more (Figure 1). While measures of forest inventory are backward looking, planted acres over the past decade do represent our future pulpwood and, eventually, sawtimber supplies. Overlaying acres planted in the South on acres of 16- to 20- year-old planted pine reveals that acres peaked in 2014 and are on track to trend lower through 2028 before exhibiting a steady recovery.

In our research, we often focus on the Great Recession’s slowdown in sawtimber harvest and resulting accumulation of forest supplies in the South to better understand the situation “on the ground.” Meanwhile, timberland investors care about the associated years of flat sawtimber prices over the past decade, despite the surge in southern lumber production.

Though having ended over a decade ago, the Great Recession continues to affect the forest industry. Direct impacts on wood demand translated into indirect impacts on timber supply, first through a surplus of sawtimber and now declining pulpwood. Pulpwood harvesting, inventories and planting have evolved during this time to help create a current situation that can be seen in prices for pulpwood and residuals.

Author: Brooks Mendell & Shawn Baker

Forisk Consulting LLC

770-725-8477

bmendell@forisk.com