Forisk Wood Fiber Review: Weather and Trucking Impacts

Energy Disrupter

Wet ground from South Carolina to Texas affected harvesting operations and pushed third quarter southern pulpwood prices higher.

- <img src="http://biomassmagazine.com/uploads/posts/magazine/2021/10/resize/iStock-Truck_16349105217651-300×300-noup.jpg" title="

PHOTO: STOCK</small>”> - <img src="http://biomassmagazine.com/uploads/posts/magazine/2021/10/resize/Cont2-Chart_1634910521812-300×300-noup.jpg" title="Figure 1. Southern hardwood, roundwood, pulpwood prices through Q3 2021.

SOURCE: FORISK WOOD FIBER REVIEW</small>”>

ADVERTISEMENT

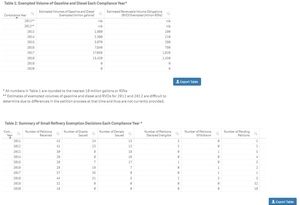

Wet ground from South Carolina to Texas affected harvesting operations and pushed third quarter southern pulpwood prices higher. Hardwood, often growing in wet (hydric) areas, suffered the greatest impact as loggers struggled to maintain production. Southern hardwood roundwood prices in the Q3 2021 Forisk Wood Fiber Review increased 7 to 8% for the quarter, up 12 to 14% year-over year (Figure 1). Constrained trucking capacity only added to the misery. “Mills are challenged to keep adequate supplies on hand due to the chaos in trucking,” says FWFR Editor Tim Gammell. Amidst a summer surge in COVID-19 cases, southern operations faced challenges on multiple fronts.

Outside the U.S. South, pulp-quality wood fiber prices remain low across much of North America. Robust sawmill production through the first half of 2021 generated abundant residual chip volumes that pushed prices lower in the Pacific Northwest, Lake States, Northeast and Eastern Canada. Pacific Northwest chip prices increased on the strength of growing wood chip export demand, but current prices remain near five-year lows across much of the region. In Western Canada, softwood chip prices are largely tied to market pulp prices for northern bleached softwood kraft (NBSK) pulp. Shawn Baker, Forisk’s vice president of research, notes, “While pulp prices declined in Q3, they remain high.” Softwood residual chip prices in Western Canada are up 10% year-over-year despite an 8% dip this quarter.

Forest industry economics still drive decisions related to operating rates and downtime. Shifting chip flows and strong prices remind us how raw material economics influence the pulp sector, where another market watcher emphasizes how “you see a plastic to paper shift” as end markets for recyclable products incent innovation for fiber-based packaging. This move is supported by the reality that conversion costs are lower for OCC than they are for virgin fiber. “We have a glut of mixed paper, too,” the market watcher remarks. This is important because wood fiber costs account for over half of total pulp manufacturing cost worldwide.

Recently, Forisk analyzed growth-to-drain in the South and Pacific Northwest. The average pine growth-to-drain for the South in 2020 was 1.31, indicating a general oversupply of timber in the region, reinforcing the continued growth of grade-using sawmill capacity, and the expectation of ample residual chip flow for years to come in the region. Looking forward to 2025, Forisk’s analysis for the region has an estimated average growth-to-drain of 1.04 (close to one). During this time, 10 sawmills and 11 pellet mills come online in the South.

The above is data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber markets, and the Forisk Market Bulletin, which tracks forest industry investments.

Author: Brooks Mendell and Shawn Baker

Forisk Consulting LLC

770-725-8477

bmendell@forisk.com

sbaker@forisk.com