Japanese oil major Eneos acquires renewables firm JRE

Energy Disrupter

Japan’s oil refiner and distributor Eneos Corporation has agreed to acquire all the shares of Japan Renewable Energy Corporation (JRE).

Renewables developer JRE is owned by US bank Goldman Sachs Asset Management and Singapore sovereign wealth fund GIC Private Limited.

The transaction is expected to close in January 2022 and is priced at more than JPY200 billion ($1.7 billion), according to local press reports.

The acquisition of JRE fits in with Eneos’s strategy to “contribute to the development of a decarbonised, recycling-oriented society”. Eneos plans to invest JPY 400 billion in renewables up to March 2023.

Established in 2012, JRE has built up a portfolio of about 60 renewable assets in Japan and Taiwan including solar, onshore wind and biomass. As of September 2021, JRE had 877MW of capacity in operation or under construction.

Ang Eng Seng, CIO of infrastructure at GIC, said: “JRE is now a leading renewable energy company in the country and GIC is pleased to have played a part in that growth. We believe the company will continue to grow under the new ownership.”

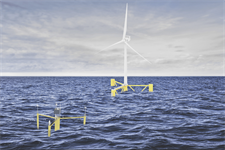

Eneos is expected to leverage JRE’s expertise to shift away from fossil fuels and become a player in the offshore wind power sector.

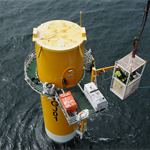

In July 2021 Eneos announced that it was collaborating with floating platform manufacturer BW Ideol to develop a commercial-scale floating offshore wind farm off Japan.

Eneos was one of six companies in a consortium led by Toda Corporation that won a Japanese government tender in June 2021 to build a 16.8MW project off Goto City, Nagasaki.

Meanwhile, JRE is co-developing a 300MW offshore wind project off Japan’s southern island of Kyushu with Wpd.

The Japanese government has a target to install 45GW of offshore wind power by 2040. Although Japan has no large-scale offshore wind farms currently in operation, it has a multi-gigawatt pipeline of planned projects.