EPA rule to rescind CAA cost-benefit analysis regs sent to OMB

Energy Disrupter

ADVERTISEMENT

The U.S. EPA is taking action to rescind a Trump-era rule finalized in December 2020 that changed the way the agency considered the costs and benefits of all significant Clean Air Act rulemakings. A final rule rescinding the existing rule was delivered to the White House Office of Management and Budget in early April.

An advanced notice of proposed rulemaking (ANPR) related to the existing rule was issued in June 2018. At that time, the EPA said it was soliciting public input on whether and how to change the way it considers costs and benefits when making regulatory decisions. The ANPR was related to Executive Order 13777, which was issued by President Trump in February 2017 and directed federal agencies to “alleviate unnecessary regulatory burdens placed on the American people.”

A proposed rule was released in June 2020, opening a public comment period. A final rule was issued in December 2020.

During the comment period, supporters of the biofuels industry submitted comments to the EPA expressing concern over how the rule would impact annual Renewable Fuel Standard rulemakings and other rulemaking processes and regulations related to renewable fuels.

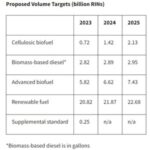

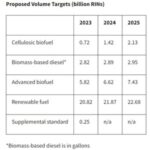

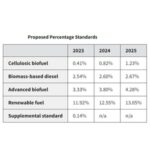

One commenter said it was unclear how the rulemaking may translate to CAA statutory provisions, such as the RFS, that require ongoing or annual rulemakings to set annual renewable volume requirements (RVOs). The comment stressed that performing a benefit-cost analysis (BCA) for each RVO would undermine the certainty and investment expectation created when the RFS was first put into force. In its response to that comment, EPA said the agency “[declines] to formulate a specific test or mandate of how to consider the BCA or what weight it should be given in such a future rulemaking. The precise details of what test would be appropriate could differ from one CAA provision to another, and the EPA has not proposed or requested comment on how such tests would be formulated under those specific provisions.”

At least one commenter also opposed retrospective review of historical BCA with regard to the RFS. The commenter said that “retrospective review could be misused to undermine the environmental progress from policies that increase the use of renewable fuel.” For example, the commenter pointed out that if a BCA analysis is done on the 2017 RVO, results of that analysis could potentially be used to retroactively alter RFS blending requirements for past years, which could create market volatility and depress demand for renewable fuels. Commenters stressed that the rulemaking did not provide a clear roadmap for how disaggregation should be applied in the context of the RFS rest or in post-2022 annual RVOs, both of which require the EPA to consider and weigh six statutory factors, some of which do not have straightforward cost or quantitative metrics. Commenters also said it was unclear how the rulemaking would affect accounting for greenhouse gas (GHG) impacts of ethanol compared to gasoline.

In response to numerous comments related to retrospective review of historical BCA, the EPA said it’s final rule would not include a requirement that retrospective analysis be undertake for all significant regulations. “Instead, EPA is committing to taking additional steps to better institutionalize the practice of conducting high quality retrospective review and analysis, which could be accomplished through the development of guidance establishing best practices for conducting retrospective analysis and how to plan for different types of retrospective analysis within its rulemaking procedures,” the agency said.

More generally, environmental groups and public health advocates criticized the rule, in part because the rule would provide less weight to “co-benefits” connected to improvements in air quality.

The Biden administration is now taking action to rescind the rulemaking. The EPA on April 8 delivered a final rule to the OMB that would rescind the Trump-era rule. OMB review marks a final step before a rulemaking is released publicly.