Coronavirus pandemic sends Siemens Gamesa to €900 million full-year loss

Energy Disrupter

Siemens Gamesa Renewable Energy (SGRE) reported a net loss of €918 million for its 2020 fiscal year, with the coronavirus pandemic taking a €1 billion hit on its balance sheet.

Its Ebit before PPA, integrating and restructuring costs was negative €233 million in the reporting period, which runs from 1 October to 30 September.

The manufacturer had made a net profit of €140 million and comparable Ebit of €725 million in its 2019 fiscal year. It reported an Ebit margin of negative 2.5% for full year and positive 1.1% for Q4

However, SGRE explained that the coronavirus pandemic had hit revenues by about €1 billion due to reduced commercial activity and delays in project execution, and impacted Ebit by about €181 million in the 2020 fiscal year.

Its revenue fell 7.3% to €9.4 billion in FY 2020, the manufacturer added.

Earlier this year, the company withdrew its financial guidance for the 2020 fiscal year due to uncertainty associated with the coronavirus pandemic.

SGRE explained that its full-year results also reflect a continuing slowdown in India and cost overruns on project execution in Northern Europe – both of which were accentuated by the coronavirus pandemic.

Despite the heavy losses, the manufacturer’s management team remains optimistic about the company’s future.

It pointed to a geographically diverse order book, “sound liquidity position” with €4.2 billion in available funding lines against which it has drawn €1.1 billion, and a “sound balance sheet” with net debt at €49 billion at the end of the fiscal year.

The company’s new management team – led by Andreas Nauen following the sudden departure of Markus Tacke earlier this year – had presented a new business plan for the fiscal years 2021-23 to return the company to profitability. Through its new three-year strategy, SGRE aims to turn around its onshore business and maintain profitable growth in offshore and service segments.

Offshore and service were the most successful divisions in the 2020 fiscal year, while onshore wind sales fell year on year.

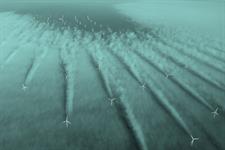

It doubled its offshore wind order intake to 4.1GW and boosted its backlog to 6.7GW, plus 9.3GW in conditional agreements. It also launched a new SG 14-222 DD turbine – currently the most powerful offshore wind turbine on the market.

Meanwhile, service is its fastest growing division, supported by assets acquired from Senvion. Its order intake rose 53% to 4.1GW for the full year, boosting its fleet under maintenance to 74.2GW.

However, its full-year onshore order intake fell 13.5% to 8.1GW, despite a late surge of 2.7GW orders signed in Q4 – though this was down 14% from the same period one year earlier.

SGRE expects revenue of €10.2-11.2 billion in its 2021 fiscal year, and then to achieve “faster-than-market growth” through to 2023. It expects an Ebit margin pre-PPA and before integration and restructuring costs of 3-5% in FY 2021.