Administration Lays the Groundwork for Hydropower Boom

Energy Disrupter

Spread the love

Tom Konrad CFA

The US Department of the Interior, the Department of Energy (DOE), and the US Army Corps of Engineers are quietly laying the groundwork for a renewable energy boom that you might not expect. What they’ve done is announce a memorandum of understanding to work together to support environmentally sustainable hydropower.

They’re not talking about building new dams, which have questionable environmental benefit, but rather to remove barriers to developing cost-effective hydropower at existing dams and waterworks.

Hydropower does not get much attention from investors. In large part, that’s because of the lack of growth. As Energy Secretary Steven Chu said, “While hydropower is the largest source of renewable electricity in the nation, hydropower capacity has not increased significantly in decades.” This new initiative won’t bring US hydropower growth up to the levels we’ve recently seen in wind or solar, but it should provide an opportunity for nimble renewable energy developers with some experience in hydropower to build profitable installations on Federal dams.

As I discussed in my overview of hydroelectric power in 2008, the main barriers to new hydroelectric facilities are complex environmental studies, permitting issues, and water laws. That’s what makes this new inter-agency cooperation so important. With the three relevant Federal agencies working together to remove barriers to development on federally owned facilities, hydroelectric developers can be reasonably confident that their investments in planning will eventually bear fruit in new hydropower generation, and not be blocked at the last minute by unexpected red tape.

I see this as part of a pattern of the Obama administration promoting renewable energy by administrative means now that legislative action looks unlikely. Other manifestations of this trend include the Administration’s recent short-list of renewable energy projects to be given priority in the environmental review and public participation process, and the DOE’s work marking out National Interest Electric Transmission Corridors.

Quite often, the barriers to clean energy are not financial, but rather the bureaucratic red tape put forward by a system that was designed for an outmoded energy paradigm. In an era of limited budgets, attacking these important non-financial barriers makes both environmental and fiscal sense.

Not So Small Hydropower

It’s not just the Feds who are pushing to tackle red tape for hydropower. Colorado Governor’s Energy Office (GEO) has a partnership with the Federal Energy Regulatory Commission (FERC) to streamline the permitting of small hydro projects in existing conduits in Colorado. The GEO expects that the first application to FERC will be filed in late April 2011, and the first permit will be issued by FERC in late July, and end after 20 applications. FERC and the state of Colorado will then assess the outcomes and look for ways in which the lessons learned can be implemented in FERC’s regular processes.

Despite the name the potential for small hydropower in the US is quite large. A 2006 Idaho National Laboratory report [PDF] found that approximately 5400 sites could be feasibly developed, enough to increase hydropower generation in the US by 50%, or an average production of 18GW, about the same as the total non-hydro renewable generation in 2010 (EIA data).

Stocks

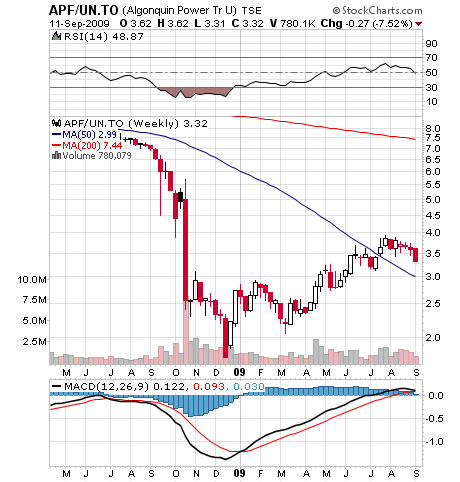

A couple stocks that might potentially benefit: AECOM Technology Corp., (NYSE:ACM) which I previously wrote about here, and Plutonic Power (TSX: PCC), which I recently wrote about because of their likely merger with Magma Energy (TSX:MXY).

DISCLOSURE: Long PCC,MXY.

This article was first published on Tom Konrad’s Green Stocks blog at Forbes.com

Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.