BP mulls selling minority stake in offshore wind — reports

Energy Disrupter

(1).png)

Referring to anonymous sources with knowledge of the situation, the Reuters news agency reported on Friday (18 October) that the fossil-fuel firm was considering the minority stake sale to reduce its share of the large investments needed to develop offshore wind projects.

The news follows reporting earlier this year that the company planned to focus on delivering its existing offshore wind portfolio and double down on fossil fuels after CEO Murray Auchincloss took over the role earlier this year.

A spokesperson for BP declined to comment.

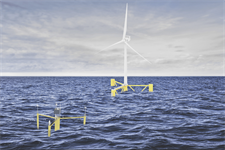

Windpower Monthly reported in June that BP aims to focus on delivering its existing “flagship” offshore wind projects, which includes the 2900MW Morven project off Scotland in the UK North Sea (co-owned with EnBW) and the 2000MW N-11.1 and 2000MW N-12.2 offshore wind projects in Germany.

A spokesperson for the oil company previously told Windpower Monthly: “We’ve built a strong portfolio over the past four years, with a net capaity of around 9.6GW, with licences/leases in the US, UK and Germany. Our focus is on developing our flagship projects (in the UK and Germany), while we will also continue to explore value-based growth in selected markets where we can be truly competitive.”

Energy Monitor reported in February that BP’s spending on renewables had “flatlined” since 2021 – the year when renewables spending hit 12% of its total annual Capex in January – falling to 6% in 2022, before reaching 8% in 2023.