Does Colombia’s first offshore wind tender signal it as a hot new market?

Energy Disrupter

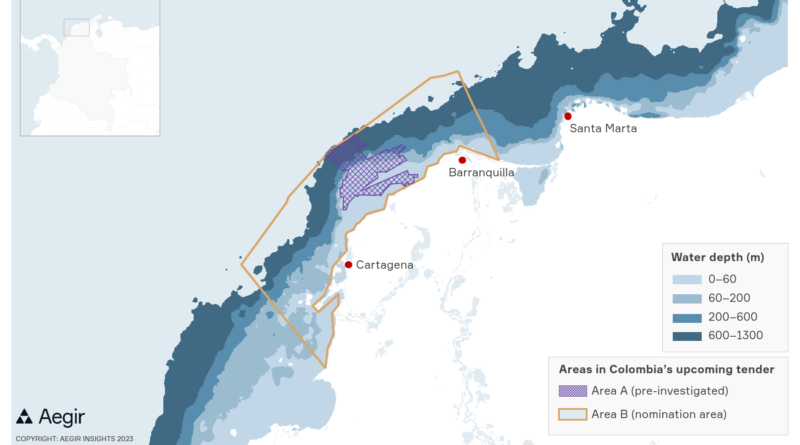

The South American country unveiled its plans for a first offshore wind tender last month, which is offering 30-year seabed leases for offshore wind projects in a large maritime area off the country’s Caribbean coast. An initial qualification period for the tender opens on 21 December.

Speaking with Windpower Monthly, Signe Sørensen, senior research analyst at Aegir, said Colombia’s offshore wind resources and planned focus on qualitative criteria makes the country a potentially attractive destination for would-be participants in the tender.

“The wind resources are good, and with limited publicly announced projects so far, plus the fact that the seabed tender will award rights based on qualitative criteria rather than price bids, Colombia could prove an attractive market to get a foothold in without having to put down large sums of money upfront,” Sørensen said.

Qualitative criteria bids will be judged on include developers’ track records in renewable energy generation, plus the securing environmental licences and their experience with technical expertise transfer programs.

Colombia generates almost 30% of its power from other renewables – mainly hydro and bioenergy – and is hoping to reach 4GW of operational renewables capacity by 2030. However, it currently only has 20MW of operational wind capacity, all of it onshore, according to Windpower Intelligence, the research and data division of Windpowe Monthly.

Colombia’s ‘just energy transition roadmap’, published in August this year, estimates the country could reach up to 7GW of offshore wind capacity by 2040.

Grid questions

The prospects for the success of its offshore wind plans could hinge on whether offtake options for future offshore wind projects can be solidified in order to attract competent developers.

“Much depends on the offtake situation, and the high case scenarios will not happen unless there are solid offtake options,” Sørensen said.

“If offshore wind in Colombia…follows the high case scenarios in the country’s offshore wind roadmap and draft just energy transition roadmap, offtake options such as contracts with producers of green hydrogen or other industries are likely to play a major role,” she said. This would be in addition to power purchase agreements (PPAs) with larger energy consumers in the Atlantico province, where the first offshore tender is planned.

Residents in the Atlantico and neighbouring Bolivar provinces nearest to the upcoming tender could subsequently see lower energy prices because future wind projects could help alleviate grid bottlenecks in the country.

The existing grid infrastructure in the region should be adequate to accommodate the planned offshore wind, though doubts about whether the grid further east on the Caribbean coast, where future tenders are planned, remain, according to Sørensen.

“The grid infrastructure near the first tender areas can accommodate a few offshore wind projects with minor upgrades. However, the grid in windy La Guajira, which is where future tenders would most likely happen, if they happen, needs extensive upgrades and entirely new grid lines. This is a known challenge, and one that is already being addressed with an eye on the onshore renewable energy production planned on the peninsula,” Sørensen said.