EPA finalizes 2023-2025 RVOs, delays implementation of eRINs

Energy Disrupter

ADVERTISEMENT

The U.S. EPA on June 21 released its final Renewable Fuel Standard “set” rule, which includes a modest increase in biomass-based diesel renewable volume obligations (RVOs) for 2024 and 2025. The agency, however, elected not to finalize provisions of the proposed rule related to eRINs.

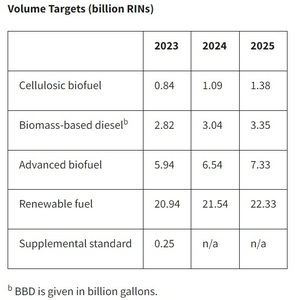

For 2023, the EPA has set the total renewable fuel RVO at 20.94 billion gallons, including the nested RVOs of 5.94 billion gallons of advanced biofuel, 2.82 billion gallons of biomass-based diesel, and 840 million gallons of cellulosic biofuel. The agency originally proposed to set the 2023 renewable fuel RVO at 20.82 billion gallons, including the nested volumes of 5.82 billion gallons of advanced biofuel, 2.82 billion gallons of biomass-based diesel, and 720 million gallons of cellulosic biofuel. The final 2023 RVO includes a supplemental RVO of 250 million gallons of renewable fuel that completes the EPA’s response to a court remand of the 2016 RFS rule.

The final 2024 and 2025 RVOs include modest increases for biomass-based diesel but reduced RVOs for advanced biofuel and cellulosic biofuel. The EPA has set the 2024 RVO for renewable fuel at 21.54 billion gallons, including the nested volumes of 6.54 billion gallons of advanced biofuel, 3.04 billion gallons of biomass-based diesel and 1.09 billion gallons of cellulosic biofuel. The proposed RVOs for 2024 were set at 21.87 billion gallons, 6.62 billion gallons, 2.89 billion gallons and 1.42 billion gallons, respectively.

For 2025, the EPA has set the total renewable fuel RVO at 22.33 billion gallons, including 7.33 billion gallons of advanced biofuel, 3.35 billion gallons of biomass-based diesel, and 1.38 billion gallons of cellulosic biofuel. The respective proposed RVOs were 22.68 billion gallons, 7.43 billion gallons, 2.95 billion gallons, and 2.13 billion gallons.

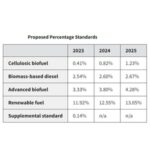

On a percentage basis, the 2023 RVO would require renewable fuel to comprise 11.96 percent of the U.S. transportation fuel pool. The 2024 and 2025 ROVs would boost that percentage to 12.5 percent and 13.13 percent, respectively.

Within the final “set” rule, the EPA attributes reductions in cellulosic RVOs to its decision not to finalize eRIN provisions of the proposed rule that would have allowed electricity generated by eligible biogas-fueled facilities to participate in the RFS program.

As proposed in December 2022, the eRIN provisions would have allowed electric vehicle (EV) manufactures to generate electric renewable identification numbers (eRINs) based on the light-duty electric vehicles they sell by establishing contracts with parties that produce electricity from qualifying biogas. Representatives of the U.S. biogas and biofuel industries lobbied against this approach, arguing that biogas electricity producers are the parties that should generate eRINs—in line with how liquid biofuel producers generate renewable identification numbers (RINs) under the RFS.

In the rule, the EPA indicates that stakeholder positions on the proposed rule’s eRIN provisions varied greatly, with some stakeholders strongly supportive of the proposed provisions, some who sought significant modifications to the program while remaining broadly supportive of eRINs conceptually, and others who opposed moving forward with any type of eRIN framework. “In light of the significant number of comments provided by stakeholders on EPA’s proposed eRIN approach, and the complexity of many of the topics raised in those comments, and the consent decree deadline on other portions of the rule, we are not finalizing the proposed revisions to the eRIN program at this time,” the EPA said the final rule. “We have adjusted the final volume requirements for this rulemaking to reflect this decision.”

“Given strong stakeholder interest in the proposed eRIN program and the range of potential benefits that the program could provide, EPA will continue to work on potential paths forward for the eRIN program,” the agency added. “To that end, EPA will continue to assess the comments received on the proposal. EPA will also seek additional input from stakeholders to inform potential next steps.”

Within the rule, the EPA also addresses its decision to maintain its proposed 2023 RVO for biomass-based diesel and include only modest increases to the 2024 and 2025 biomass-based diesel RVOs.

The rule cites U.S. Energy Information Administration data that projects U.S. renewable diesel production capacity could reach nearly 6 billion gallons by 2025, but cautions that some of those projects may not be completed, and the ones that are won’t necessarily produce renewable diesel in the 2023-2025 timeframe addressed by the “set” rule. The EPA also discusses concerns over feedstock limitations that could result in renewable diesel and biodiesel facilities operating at below capacity notes that competition for qualifying feedstocks could also reduce in reductions in biodiesel production if larger renewable diesel facilities are able to out-complete smaller biodiesel producers for feedstock.

The EPA also points to the structure of the RFS program’s nested RVOs in justifying its decision. According to the agency, it believes that excess volumes of biomass-based diesel beyond the biomass-based diesel RVOs will be used to satisfy the advanced biofuel RVOs, within which the biomass-based diesel volume requirement is nested.

“We also believe it is important to maintain space for other advanced biofuels to participate in the RFS program,” the EPA said in the rule. “Although the [biomass-based diesel] industry has matured over the past decade, the production of advanced biofuels other than biodiesel and renewable diesel continues to be relatively low and uncertain. Maintaining this space for other advanced biofuels can in the longterm facilitate increased commercialization and use of other advanced biofuels, which may have superior environmental benefits, avoid concerns with food prices and supply, and have lower costs relative to [biomass-based diesel]. Conversely, we do not think increasing the size of this space is necessary through 2025 given that only small quantities of these other advanced biofuels have been used in recent years relative to the space we have provided for them in those years.”

The final rule also includes a variety of other regulatory changes that the EPA said aim to strengthen its implementation of the RFS program. This includes modification of regulatory provisions for biogas-derived renewable fuels to ensure that biogas is produced from renewable biomass and used as a transportation fuel and allow for the use of biogas as an biointermediate; enhancements to third-party oversight provisions, including engineering reviews, the RFS quality assurance program, and annual attest engagements; establishing a deadline for third-party engineering reviews for three-year registration updates; updating procedures for the apportionment of RINs when feedstocks qualifying for multiple D-codes are converted to biogas simultaneously in an anaerobic digester; revising the conversion factor in the formula for calculating the percentage standard for biomass-based diesel to reflect increasing production volumes of renewable diesel; flexibility for RIN generation; reiterating the prohibition on generating RINs not used in the covered location; flexibilities for the generation and maintenance of records for waste feedstock; clarifying the definition of fuel used in ocean-going vessels; modifications to the bonding requirements for foreign parties that participate in the RFS program; and other minor changes and technical corrections.

In general, representatives of the U.S. biofuels industry are criticizing the final “set” rule, describing it as a missed opportunity and disappointment.

Clean Fuels Alliance America is slamming the final RVOs and expressing “extreme disappointment” in the EPA’s rulemaking, noting the agency finalized moderate increases in the biomass-based diesel and advanced biofuel RVOs, but did not increase the overall renewable fuel market. The group also stressed that the agency failed to increase the 2023 RVO for biomass-based diesel despite the rapid increase in U.S. production of biodiesel, renewable diesel and sustainable aviation fuel (SAF) during the first months of the year.

“EPA is undercutting the certainty that our industry hoped for from a three-year RFS rule,” said Kurt Kovarik, vice president of federal affairs with Clean Fuels. “U.S. clean fuel producers, oilseed processors, fuel distributors and marketers have all made significant investments to grow the industry rapidly over the next several years. The industry responded to signals from the Biden administration and Congress aiming to rapidly decarbonize U.S. fuel markets, particularly aviation, marine, and heavy-duty transport, and make clean fuels available to more consumers. The volumes EPA finalized today are not high enough to support those goals.”

“Clean Fuels appreciates the bipartisan support of Representatives, Senators and Governors who asked EPA to ensure that final volumes supported achievable, aggressive growth of advanced biofuel volumes,” Kovarik added. “It is a shame that EPA failed to fully consider the data provided by other federal agencies and industry experts demonstrating the upward trajectory of our industry.”

“Worst of all, EPA ignores the hundreds of millions of gallons of biodiesel, renewable diesel and sustainable aviation fuel generated in the first half of 2023,” Kovarik continued. “In past years when EPA set RFS volumes after the statutory deadline and after the compliance year is nearly half over, the agency properly accounted for available gallons and RINs.”

The Renewable Fuels Association said the “set” rule fails to deliver on the promise of the original proposal, noting the final rule includes conventional renewable fuel requirements of 15 billion gallons for both 2024 and 2025, down from the proposed volumes of 15.25 billion for both years. RFA called the reductions “inexplicable and unwarranted.”

“The RFS was intended to drive continual growth in all categories of renewable fuels well beyond 2022; instead, today’s final rule flatlines conventional renewable fuels at 15 billion gallons and misses a valuable opportunity to accelerate the energy sector’s transition to low- and zero-carbon fuels,” said Geoff Cooper, president and CEO of the RFA. “By removing half a billion gallons of lower-carbon, lower-cost fuel, today’s rule needlessly forfeits an opportunity to further enhance U.S. energy security and provide more affordable options at the pump for American drivers.”

Despite the rule’s failure to finalize the strong proposed conventional renewable fuel volumes, the action “includes solid volumes for other renewable fuel categories and brings some stability and predictability to the marketplace for the next two and a half years,” Cooper said. “Despite the disappointing reduction in conventional renewable fuel numbers, we appreciate the fact that President Biden and EPA Administrator Michael Regan have continued to prioritize renewable fuels in our nation’s energy and climate strategy.”

RFA also welcomed EPA’s announcement that it would not implement RINs for electricity (eRINs) as part of today’s final rule. As the organization noted in oral testimony and written comments to EPA, the agency’s initial proposal for incorporating eRINs into the RFS was overly complex and inconsistent with RIN generation provisions for all other renewable fuels. RFA joined several other stakeholder groups in encouraging EPA to reconsider its eRIN proposal and take more time to get it right.

“We appreciate that EPA was responsive to the many questions and concerns raised by numerous stakeholders regarding eRINs, and we believe the agency did the right thing by calling a timeout on implementation of those provisions,” Cooper said. “We look forward to continuing to engage with EPA on the best methods for bringing renewable electricity into the RFS program.”

The American Coalition for Ethanol is also criticizing the RFS “set” rule for arbitrarily limiting the participation of conventional biofuel in the RFS. “If EPA’s goal with the Renewable Fuel Standard is to maximize reductions in greenhouse gas (GHG) emissions from the transportation sector, today’s final rule falls short by arbitrarily limiting conventional biofuel use to 15 billion gallons in 2024 and 2025 compared to the agency’s proposal of 15.25 billion gallons for each of those years,” said Brian Jennings, CEO of ACE. “Higher blending targets would enable fuels such as E15 and E85 to quickly displace carbon pollution from gasoline, but EPA’s proposal will rein in those opportunities.

“We are supportive of finalizing the 250-million-gallon remedy as a supplemental requirement for 2023 and agree with removing the controversial eRIN proposal from the final rule,” he added.

“ACE’s experience with EPA’s oversight of the RFS over time requires us to remain vigilant to ensure mismanagement or unwarranted waivers are not used to undermine the physical blending of ethanol that has required litigation to rectify in previous years,” Jennings added. “We will also continue to press the agency to once and for all update its antiquated greenhouse gas (GHG) model assumptions about corn ethanol. We continue to urge EPA to follow the science and adopt the latest GREET model for its lifecycle modeling, consistent with what Congress required of Treasury in the Inflation Reduction Act 45Z clean fuel production tax credit.”

Growth Energy said the rule undermines the growth potential of low-carbon biofuels. “The RFS remains one of America’s most successful clean energy policies, but, yet again, its full potential as a climate solution remains untapped,” said Emily Skor, CEO of Growth Energy. “EPA’s decision to lower its ambitions for conventional biofuels runs counter to the direction set by Congress and will needlessly slow progress toward this administration’s climate goals.

“We should be expanding market opportunities for higher blends like E15, not leaving carbon reductions on the table,” she added.

“While the final rule offers a modest improvement in advanced volumes, EPA inexplicably failed to extend that recognition to conventional biofuels,” Skor continued. “The bioethanol industry has more than adequate supply to meet the higher volumes that were originally proposed in December 2022. Choosing not to put that supply to good use in decarbonizing the transportation sector runs counter to this administration’s previously-stated commitments and undermines the goal of reaching net-zero by 2050.”

The Coalition for Renewable Natural Gas (RNG Coalition) is expressing support for EPA’s treatment of RNG-based fuels in the “set” rule, but said the agency has missed an opportunity to further decarbonize U.S. transport by delaying action on eRINs.

“RNG demand continues to grow under this proposal and EPA is sending a clear signal recognizing RNG as an important part of America’s clean fuel present and future,” said Johannes Escudero, founder and CEO of the RNG Coalition. “Operational RNG facilities in North America have grown tenfold since 2011, to 293 facilities today, and our industry stands ready to capture methane emissions from organic waste and supply increasing volumes of RNG.”

“Good public policy would support promoting renewable electricity as part of the nation’s transportation policy,” Escudero added. “Biofuels play a critical role in electricity generation for EV charging. By not including eRINs now, EPA is foregoing an aspect of the program that could have been an accelerator for methane capture and cleaner air.”

The RNG coalition is urging the EPA to finalize and implement the eRIN pathway promptly, recognizing long-standing Congressional support for implementation, the backing of numerous, cross-industry stakeholders and the urgency with which the U.S. must pursue all means to address climate change. The group said it will continue to engage productively with EPA pursuant to finalizing an eRIN proposal.

The American Biogas Council applauded the RFS “set” rule for its provisions related to biogas reform and biointermediates and the agency’s new methodology for biogas systems that accept food waste in addition to agricultural waste or wastewater sludge. “With EPA’s Final SET Rule, biogas systems will serve a foundational role in the future growth of the renewable transportation fuel industry, reducing methane emissions, and increasing food waste recycling,” said Patrick Serfass, executive director of the ABC.

“RIN values will be strengthened and stabilized with EPA’s recognition of the strong, 20-40percent RNG market growth the industry is experiencing today; new markets will open related to the RFS with biogas now able to replace conventional natural gas to produce non-RNG transportation fuels like ethanol, gasoline, and diesel; small farms will find it easier to build biogas systems to produce RNG by recycling food waste on site; and the RFS will now help close the gap between federal policy on food waste and the more developed, state-based food waste recycling laws,” he added. “All of this will help the biogas industry scale and achieve greater environmental protection.

“We look forward to working with the Biden Administration and EPA to recognize biogas systems’ contribution to electric vehicles through electricity and fuel cells, and their complimentary role in decarbonizing the transportation sector,” Serfass continued. “The biogas and finance industries have already shown they’re ready to act, based on the reaction to the proposed SET Rule. Now, it’s up to the Administration to finish what Congress created and allow biogas-electricity systems to modernize and continue to decrease the carbon footprint of the U.S. transportation.”

A full copy of the final RFS “set” rule can be found on the EPA website.