How to Lower Your Home Energy Bill – TIME

Energy Disrupter

Even as Americans begin to see some relief from inflation that hit 40-year highs, many household budgets are still feeling a significant pinch. That’s at least partly because home energy costs were 15.6% higher year-on-year in December due to the rising cost of natural gas, heating oil, propane, and electricity.

The good news: there’s still time to take steps to make your living space more cozy and cost-effective. And you don’t need to spend an absurd amount of money to do it—many of the fixes can be done on your own and qualify for federal tax credits included in the Inflation Reduction Act.

Here are some tips on how you can lower your energy bill this winter.

Insulate your attic

The best place to start looking for monthly energy savings is your attic if you’ve got one. Just as wearing a hat in the winter keeps you warm, repairing or adding insulation at the top of your home can help prevent heat from escaping, says Curt Rich, the president and CEO of the North American Insulation Manufacturers Association.

“The first step that you need to take with your home before you do anything else,” he says, “is make sure that it’s well insulated.”

You can find out where insulation is needed by inspecting your attic and looking for any gaps around pipes and ducts. Any insulation that has shifted can simply be repositioned, but some homeowners may want to have extra insulation added.

A construction worker installs insulation in a home.

Universal Images Group via Getty Images

Rich says households can save anywhere between 10 to 45% on energy bills each year by putting more insulation in their attics or floors and sealing up visible cracks. Roughly nine out of 10 homes in the U.S. are currently under-insulated, particularly in attics, says Leslie Jones, a spokesperson for ENERGY STAR, which researches and promotes cost-effective ways to make homes more energy efficient.

It’s also a good long-term investment. Once installed, insulation typically lasts for the entire lifetime of the home. “There’s no degradation in the thermal performance of insulation over time,” Rich says. “We’ve pulled insulation out of homes that are 50 to 75 years old, and the insulation is performing as well as the day it was installed. It’s not like air conditioning or heating equipment that has a 15 year life span.”

In addition to attics, insulation can be installed in walls, ceilings with unheated spaces and crawlspaces.

And there’s a financial incentive for homeowners: Adding insulation can get you a tax credit of up to $1,200 for the material used, according to ENERGY STAR.

“I think you’ll see increased homeowner interest in insulation going forward over the next few years because of the tax credit,” Rich says, citing data from the Treasury Department that shows demand skyrocketed after Congress increased the Energy Efficient Home Improvement Credit to $1,500 in 2009.

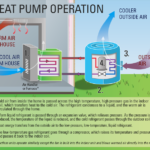

Consider switching to a heat pump

Swapping your gas furnace or water heater for a heat pump can have enormous cost benefits—not to mention cutting down on carbon emissions and making homeowners eligible for a tax credit of up to $2,000. The tax incentive is currently available as part of the Inflation Reduction Act.

Switching to a heat pump can save homeowners anywhere from $100 to $1,200 per year on heating bills, according to one analysis using data from the National Renewable Energy Laboratory. These appliances run on your home’s electricity and move heat rather than creating it, making heat pumps more energy efficient than traditional gas or electric heaters.

Modern heat pumps can even heat a home when outdoor temperatures drop to as low as 31 degrees below zero Fahrenheit.

But some contractors say electric heat pumps are only part of the solution and must be combined with other cost-saving measures like putting in new insulation or sealing up window cracks. “You’ve got to look at your home as a system,” Rich says. “All of these measures work together. If you want optimal utility bill savings, you can’t just put new equipment in a house that’s really drafty and isn’t well insulated.”

Installing a heat pump costs $4,200 to $7,600—or more if you choose a high-efficiency model, according to HomeAdvisor, a contractor-matching service.

Schedule a residential energy assessment

Homeowners should also check their doors and windows for leaks that can be sealed. Some gaps may be obvious, such as a draft between a window and its frame, but others may be less visible.

You can get a full picture of your home’s heating profile by scheduling a residential energy assessment—also known as an energy audit—with a professional. These assessments often involve a calibrated blower door test that depressurizes your house and draws in air through any gaps, allowing auditors to track the areas that should be sealed or insulated.

A home energy audit can cost between $200 and $500, depending on location and house size, though the Inflation Reduction Act offers a $150 tax credit per household to help cover the cost.

Turn down the thermostat

This one’s obvious, but worth noting. Turning down your thermostat when you are sleeping or away will save you money. Some thermostats can even be programmed to do it automatically.

The U.S. Energy Department recommends setting the thermostat at 68 degrees while you’re awake, and lowering it while sleeping. Households can save up to 10% a year on heating by lowering their thermostat by 7 to 10 degrees Fahrenheit, according to the Energy Department.

“Heating and cooling systems are some of the most energy intensive systems in your home,” Jones says. “So if you’re going to prioritize upgrades that you can make to really control your energy usage, I would suggest upgrading to a smart thermostat.”

Let natural sunlight in and seal gaps

A simple way to reduce your heating and electricity expenses is to open up curtains and shades during the day to let natural sunlight warm your home and provide light. Since electricity rates tend to be the highest during the day, letting natural sunlight in during the daytime can lower your electricity bills significantly, particularly if you use older incandescent light bulbs (Jones recommends using LED light bulbs, which use 90% less energy).

Just make sure there aren’t any cold drafts around your windows that could counteract the warming effect of sunlight. Those pesky drafts can be dealt with by applying weatherstripping or removable caulk, or by installing a plastic window film to reduce heat loss.

Use a dishwasher

It may be hard to believe, but an electric dishwasher is actually more energy-efficient than hand washing your dishes—if you have a newer dishwasher and you’re washing full loads.

Hand washing dishes in the sink can use up to 27 gallons of water per load, while an ENERGY STAR certified dishwasher can use as little as 3 gallons per load, according to the Natural Resources Defense Council. “It would save you about $130 a year if you were to use a dishwasher over hand-washing,” Jones says. “We always recommend making sure you just scrape things, you know and just load them into your dishwasher and let that do the work. You have to take into consideration the cost to heat the water that you’re using.”

So you can put the sponge away and get the dishwasher started instead.

Consider federal or state assistance programs

Low-income families may qualify for financial help if they can’t afford their heating bills. Households can apply for assistance from the federal Low Income Home Energy Assistance Program, or LIHEAP, a federal initiative that helps people nationwide cover their heating and cooling bills.

“Without LIHEAP,” an Illinois resident told TIME in October, “I would not make it through winter.

Each state determines who’s eligible for the program based on income limits. For example, a family of four in Maine—where more expensive fuel oil is a common heat source—is eligible if their gross income is less than $59,348. Local nonprofit groups often help distribute the money, which recipients receive as a credit on their energy bills.

Roughly 5 million households received assistance with heating costs through LIHEAP last year, costing an estimated $2.9 billion.

“Most people when they’re thinking about saving, the first thing that probably comes to mind is what’s available at the retailer where they’re making a purchase,” Jones says. “But there’s a number of tax credits and incentives that homeowners can take advantage of too.”

More Must-Reads From TIME

Original Source: https://news.google.com/__i/rss/rd/articles/CBMiN2h0dHBzOi8vdGltZS5jb20vNjI0ODg3MC9ob3ctdG8tbG93ZXItZW5lcmd5LWJpbGwtaG9tZS_SAQA?oc=5