Biofuel groups offer testimony on EPA’s proposed RFS ‘set’ rule

Energy Disrupter

<img src="https://biomassmagazine.com/uploads/posts/web/2023/01/resize/RFSProposedRVO2023_25_1_16733948051742-300×300-noup.jpg" title="SOURCE: U.S. EPA

</small>”>

<img src="https://biomassmagazine.com/uploads/posts/web/2023/01/resize/RFSProposedRVO2023_25_2_16733948052024-300×300-noup.jpg" title="SOURCE: U.S. EPA

</small>”>

ADVERTISEMENT

The U.S. EPA on Jan. 10 held a virtual public hearing to gather public comments on its proposed Renewable Fuel Standard “set” rule, which includes renewable volume obligations (RVOs) for 2023, 2024 and 2025 and outlines the agency’s plan for the generation of electric renewable identification numbers (e-RINs) from eligible sources of biomass-based electricity. Representatives of the ethanol industry have largely spoken out in support of the proposed rule, while renewable diesel and biodiesel groups are critical of the proposed rule’s relatively low targets for biobased diesel fuels. A public comment period on the proposed rule remains open through Feb. 10.

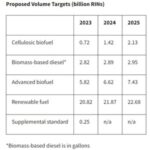

The EPA released the proposed “set” rule on Dec. 1. The rulemaking proposes to set the 2023, 2024 and 2025 RVOs at 20.82 billion gallons, 21.87 billion gallons, and 22.68 billion gallons, respectively. A 250-million-gallon supplemental obligation would also be imposed for 2023. That supplemental obligation aims to address remand of the 2014-2016 annal rule by the D.C. Circuit Court of Appeals in Americans for Clean Energy v. EPA. A similar 250-million-gallon supplemental obligation was implemented for compliance year 2022.

For 2023, the EPA has proposed to set the total RVO at 20.82 billion gallons, up 190 million gallons when compared to the 2022 RVO finalized earlier this year. The 2023 blend target includes the nested requirements of 720 million gallons of cellulosic fuel, 2.82 billion gallons of biomass-based diesel and 5.82 billion gallons of advanced biofuel. Conventional biofuels, such as corn ethanol, could fill up to 15 billion gallons of the RVO requirement. The 250-million-gallon supplemental obligation boosts the total 2023 obligation to 21.07 billion gallons.

For 2024, the EPA is proposing to increase the total RVO by 1.05 billion gallons to 21.87 billion gallons, including 1.42 billion gallons of cellulosic biofuel, 2.89 billion gallons of biomass-based diesel, and 6.62 billion gallons of advanced biofuel. Those nested requirements would allow for up to 15.25 billion gallons of conventional biofuel to be used by obligated parties to fill their blend requirements.

For 2025, the agency proposes to increase blend obligations by an additional 810 million gallons to 22.68 billion. The nested RVO would include 2.13 billion gallons of cellulosic biofuel, 2.95 billion gallons of biomass-based diesel, and 7.43 billion gallons of advanced biofuel. The volume of conventional biofuels that can be used to meet RFS blend requirements would be maintained at 15.25 billion gallons.

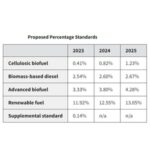

On a percentage basis, the 2022 RVO requires biofuels to account for 10.82 percent of transportation fuel. The RVOs for 2023, 2024 and 2025 would boost the biofuel blend levels to 11.92 percent, 12.55 percent and 13.05 percent respectively.

In its comments, the Renewable Fuels Association called the RVO proposal a “firm foundation” for the future of the RFS. “Overall, we believe the proposed ‘Set’ rule establishes a firm foundation for the future of the RFS and creates a pathway for sustainable growth in the production and use of low-carbon renewable fuels,” said Geoff Cooper, president and CEO of the RFA. “Once finalized, the rule will further enhance our nation’s energy security, reduce carbon emissions, and strengthen the rural economy.”

Growth Energy applauded the implied targets for conventional biofuels. “We are greatly encouraged by EPA’s strong Set proposal with implied conventional biofuel volumes at 15 billion gallons for 2023 and increasing to 15.25 billion gallons for 2024 and 2025,” said Emily Skor, CEO of Growth Energy. “Moving forward, our opportunities for growth across both conventional and advanced biofuels are linked, so it is important that the proposed volumes reflect industry growth and innovation. Specifically, we ask that EPA clear the backlog of pathway approvals for renewable fuels, including cellulosic biofuels from kernel fiber, advanced biofuels from corn oil produced at bioethanol wet mills, and bioethanol produced using carbon capture technologies.”

“We also ask that EPA account for the innovation in the biofuels industry, which requires updated lifecycle emissions modeling to reflect the best available science on low-carbon bioethanol that will be used not only to decarbonize our on-road fleet, but also for sustainable aviation fuel,” Skor added.

The American Coalition for Ethanol’s testimony emphasized key areas to grow biodiesel demand in the “set” rule. In his testimony, ACE CEO Brian Jennings spoke out in support of the proposed rule’s implied targets for conventional biofuel, the EPA’s projection that no small refinery exemptions (SREs) will be approved for compliance years 2023-2025, and the agency’s indication that its antiquated greenhouse gas (GHG) model needs to be updated. Jennings, however, expressed concern over inadequate advanced biofuel blending targets and the agency’s “alternative approach” to reduce conventional blending to below 14 billion gallons for 2024 and 2025.

Clean Fuels Alliance America and its members expressed frustration with the low RVO targets for biomass-based diesel fuels. “The proposed rule significantly undercounts existing biomass-based diesel production and fails to provide growth for investments the industry has already made in additional capacity, including for sustainable aviation fuel,” said Donnell Rehagen, CEO of Clean Fuels.

Clean Fuels cited EPA data that shows the U.S. market exceeded 3 billion gallons of biomass-based diesel in 2021 and 2022. The group also pointed to the U.S. Energy Information Administration’s Short Term Energy Outlook, which projects a 500-million-gallon increase in biodiesel and renewable diesel consumption for 2023. But EPA’s proposed volumes for the biomass-based diesel category limit growth in the category to 65 million gallons per year through 2025 and do not reach 3 billion gallons even in the final year, according to Clean Fuels.

“Clean Fuels is once again frustrated that EPA has the wherewithal needed to determine current production, the knowledge of the investments being made, and the resources to accurately determine feedstock availability — yet proposes a no growth scenario,” said Kurt Kovarik, vice president of federal affairs at Clean Fuels.

The Iowa Biodiesel Board also urged the EPA to reconsider its proposed targets for biomass-based diesel. “The proposed volumes for biomass-based diesel and overall advanced biofuel volumes through 2025 are not consistent with the industry’s projected growth, or with the Administration’s own goals to reduce greenhouse gas emissions,” said Grant Kimberley, executive director of the IBB. “Sending the right market signals through increased volumes, in contrast to what EPA currently proposes, would boost our state’s rural economy and Iowa soybean farmers, who rely on strong commodity demand to support their livelihoods and feed the world.”