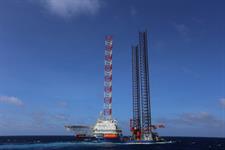

UK wind industry backs call to decouple renewable electricity from gas

Energy Disrupter

Industry bodies RenewableUK and Energy UK believe that creating new fixed-price, longer-term contracts with project operators receiving lower returns would help to reduce pressure on UK consumers.

The UK Energy Research Centre think tank has proposed that wind and other renewable projects, currently supported by the Renewables Obligation (RO) scheme, should be able to opt for new long-term, fixed-price contracts at prices lower than the current wholesale market price.

Authors of the think tank’s ‘Can existing renewables and nuclear help keep prices down next winter?’ discussion paper likened their proposed mechanism to contracts for difference (CfDs), whereby operators receive a fixed price regardless of the market price, which fluctuates according to the price of gas.

Gas – as the last and most expensive unit of generation the grid needs in order to ensure demand is met – sets wholesale prices, the UK Energy Research Centre explained. With gas prices surging since Russia began reducing volumes sent to Europe in preparation for its invasion of Ukraine in February, so have wholesale market prices and consumers’ energy bills.

The think tank suggested that project operators might opt in to the scheme as RO contracts for their projects expire to ensure continuing, stable returns.

And a RenewableUK spokesman explained that while the proposed scheme might see project operators forgoing some revenue initially, contracts with longer durations could mean their returns even out in the long run. However, the length of the new contracts has not yet been specified in the current proposal.

RenewableUK believes the proposed scheme would ensure that the long-term costs of keeping these renewables running would be met, while shielding consumers from market prices set by expensive gas.

Under the RO scheme, generators trade their power on the market and receive a fixed subsidy through 20-year contracts to cover the investment cost of more expensive, older renewables. It closed to new projects in 2017. The UK now holds CfD tenders for renewables, which have seen prices fall across four rounds.

RenewableUK’s CEO Dan MacGrail said the trade body was keen to work with the government – which is set to appoint a new prime minister next week – about how the proposal could be implemented.

He added: “It makes no sense to allow the exorbitantly expensive cost of gas to set the price for the whole of the electricity market. This proposal is a step forward towards breaking that outdated link.

“It will enable bill payers to benefit more from the vast amounts of low-cost electricity being generated by wind and other renewables, which are our cheapest new power sources.”

The proposal comes amid soaring energy bills, with the expectation of even higher costs to come. UK energy regulator Ofgem last week announced an 80% increase in the average annual household energy bill from October.