Wood Mackenzie: Boom year for China’s wind turbine manufacturing capacity ‘challenges western markets’

Energy Disrupter

China’s renewables manufacturers and project developers’ scale and cost-competitiveness threatens other countries’ plans for industrial growth and job creation from renewables, according to Wood Mackenzie.

These companies “have emerged from 2021 bigger and more competitive than ever before”, according to the analysts’ new report, Power Play.

“China’s dominance in clean energy manufacturing is causing increasing consternation for those committing to delivering emissions reductions complete with immediate and visible economic benefits”, the report stated.

Many other governments have been pledging to make job creation a key part of realising their green targets – for example, this month the UK proposed taking a stricter approach to so-called ‘supply chain plans’ that require UK content in offshore wind farms.

But the report said in 2021 China’s “phenomenal domestic power demand drove investment to record levels,” and it is “building more, faster and cheaper than anyone else”.

Chinese power demand – up 10% in 2021 – was behind the boom, with more than 100GW of wind and solar installed since 2020.

Demand growth is now expected to slow, as economic growth slows, but Wood Mackenzie says wind turbine component manufacturing will grow by 42% over the next two years. “The pace of manufacturing growth will comfortably allow China to deliver much of what the rest of the world needs to accelerate decarbonisation,” the analysts added. They have not clarified how this 42% growth is measured.

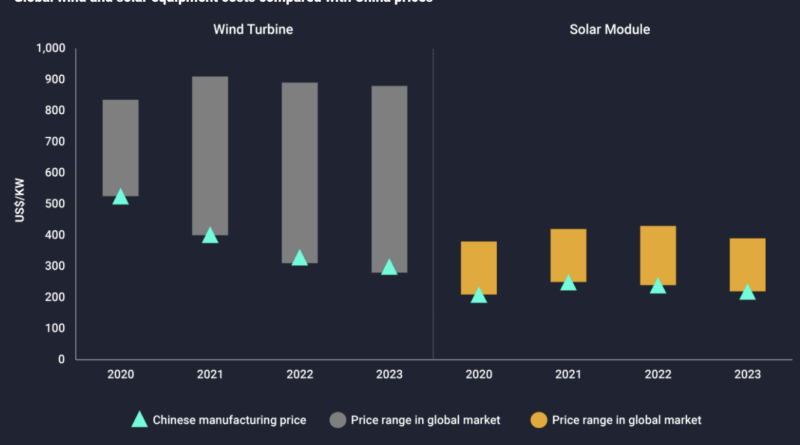

Wood Mackenzie stated that Chinese wind turbine prices fell by 24% in 2021 and are expected to drop by a further 20% in 2022, putting projected Chinese prices of around $300,000/MW in 2023 at the bottom of the global market (see above).

Principal analyst Xiaoyang Li explained: “The sheer scale of its manufacturing capacity affords China a major competitive advantage. Despite increases in raw material prices since 2020, China’s massive expansion in clean energy manufacturing and ability to scale up output has seen its manufacturing costs decrease relative to its global competitors.”

By contrast, western turbine manufacturers have raised their prices to offset supply chain challenges and cost inflation in recent months. For example, Danish OEM Vestas reported an average selling price of its onshore and offshore turbines of €830,000/MWh ($943,000/MWh) in 2021.

Meanwhile, China’s turbine manufacturing capacity is expected to reach 80GW in 2022/23, compared to its domestic demand for new turbines of 60GW. It currently supplies 50% of the global turbine market.

Wood Mackenzie says global manufacturers that can compete against China are those that produce larger and more efficient units with lower lifetime costs and fewer outages.