The Fiber Takers

Energy Disrupter

ADVERTISEMENT

Alongside a working group of members, the Pellet Fuels Institute is updating some messaging documents that outline the societal, economic and environmental benefits of wood pellet production and use. This effort has included a thorough vetting of the myriad claims and benefits our organization has championed, trumpeted or touted over the course of the past decade. Those well acquainted with our sector have heard our story of rural jobs, localized energy expenditures and low-carbon heating before, and they are no less relevant today than they were when we started sharing them. Still, over the course of our efforts, our role as fiber takers continues to shine most brightly as an irrefutable, undeniable reality of our contribution to the larger forest products sector. Industry, including wood pellet manufacturing, will always have its detractors. Those detractors work tirelessly to poke holes in the various value propositions industry proponents bring forward, including the arguments proffered by the Pellet Fuels Institute. Fortunately, our annual expenditures and annual volumes of sawmilling and wood product manufacturing residuals are tracked and reported by the U.S. Energy Information Administration, and have been since 2016. The accumulated data tells a compelling story measured in billions of dollars spent on what otherwise might be considered waste.

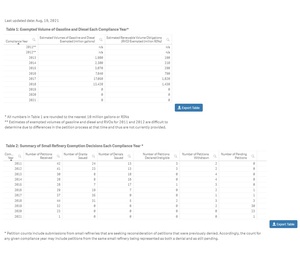

When the EIA launched its Monthly Densified Biomass Fuel Report, it began tracking feedstock purchases by wood pellet manufacturers in four different categories: sawmill residuals, wood product manufacturing residues, other residuals and roundwood/pulpwood. Both tonnage and cost per ton are reported in each category every month. A deep dive into the data makes it clear that wood pellet manufacturing provides not only a home for an incredible volume of material, but also extends the overall value of wood via these ongoing residual purchases.

Consider the numbers from 2020 alone. Last year, wood pellet producers purchased 4.1 million tons of sawmill residuals worth $134 million, 4.6 million tons of wood product manufacturing residuals worth $171 million and 5.7 million tons of other residuals worth $172 million. Collectively, that’s 14.5 million tons of shavings, chips and sawdust worth nearly $500 million. 14.5 million tons can be difficult to picture. Instead, imagine a convoy of tractor trailers over 7,000 miles long. For reference, Anchorage is about 5,000 road miles from Miami. This imagined convoy, with trucks inching along bumper to bumper would thread all the across Canada and the U.S. and halfway back again. Most importantly, these materials are generated because of the manufacture of other, higher-value products, and they must go somewhere. Waste professionals constantly bemoan the general public’s struggle to grasp the concept of waste streams and what happens to them. These professionals often joke about the mythical place called “away,” where waste ultimately goes. The joke, of course, is that there is no “away,” and that these materials—whether they be food waste, standard municipal solid waste (MSW), sawdust or wood chips—must go somewhere. Typically, disposal of waste streams comes at a cost. For MSW, these costs come in the form of tipping fees. The Environmental Research & Education Foundation tracks the national average for tipping fees, and reported that in 2019, the nationwide average was $55.36 per ton. Imagine, for a moment, that instead of being purchased by wood pellet manufacturers, every ton of these manufacturing residuals had to be landfilled. At $55.36 per ton, the cost to wood product manufacturers would be a staggering $802 million. Because of the demand generated by wood pellet manufacturers, this potential $800 million expense is transformed into a $500 million revenue stream, a swing of over $1.3 billion.

As a sector, we need to make more of this compelling reality, and attract more people and more constituents to our various causes.

Wood pellet manufacturing is a vital piece of our country’s forest product sector. As fiber takers, we allow our upstream partners to focus on the manufacture of high-value forest products with the full confidence that consistent, reliable offtake partners stand ready to convert those materials into a low-carbon, cost-effective home heating solution relied upon by millions of Americans each winter.

Author: Tim Portz

Executive Director, Pellet Fuels Institute

tim@pelletheat.org

www.pelletheat.org