Report: EU wood pellet demand expected to increase in 2020

Energy Disrupter

ADVERTISEMENT

An annual report filed with the USDA Foreign Agricultural Service’s Global Agriculture Information Network shows that the European Union’s wood pellet market has been relatively unaffected by the COVID-19 pandemic but cautions further market expansion could be limited by member state sustainability requirements.

According to the report, the EU consumed approximately 29 million metric tons of wood pellets in 2018, making the EU the world’s largest pellet market. The report predicts wood pellet demand will expand to 30.8 million metric tons in 2020.

Residential use of wood pellets for heating accounts for approximately 40 percent of the EU pellet market and is relatively stable when compared to demand for industrial heat and power generation. Italy and Germany are currently the main growth markets for residential heating.

The report predicts if EU demand and trade flows remain consistent with current patterns, the U.S has the potential to supply 65 percent of EU import demand for wood pellets, which would represent a trade value of approximately $1.6 billion in 2020.

Manufacturers in the EU are expected to produce 18.5 million metric tons of wood pellets this year, up from 17.7 million metric tons last year. Imports are expected to reach 12.5 million metric tons, up from 11.48 million metric tons in 2019. Total wood pellet consumption is expected to reach 30.8 million metric tons in 2020, up from 29.1 million metric tons last year.

The EU currently has approximately 25 million metric tons of wood pellet production in place, with capacity use at 74 percent.

According to the report, the EU currently produces approximately 30 percent of world pellet production, but accounts for 50 percent of global consumption.

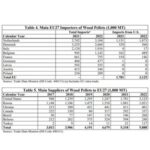

The U.K. is the top pellet consumer, with 9 million metric tons last year, followed by Italy at 3.3 million metric tons and Denmark at 2.5 million metric tons.

Germany is the main pellet producing country in the EU, with 2019 production reaching 2.82 million metric tons, followed by Sweden at 1.625 million metric tons and Latvia at 1.6 million metric tons.

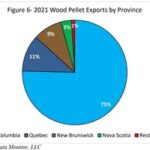

The U.S. was the top supplier of wood pellets to the EU in 2019 with 6.779 million metric tons, followed by Russia at 1.689 million metric tons and Canada at 1.624 million metric tons.

Regarding sustainability, the report notes that European traders and end-users of industrial wood pellets are calling for clear, consistent, harmonized, and long-term government regulations. In the absence of EU-wide sustainability criterial, several member states have developed their own sustainability rules, including Belgium, Denmark and the Netherlands. In the RED II, the report notes that the sustainability of biomass production will be assessed at the sourcing level, and not at the forest-holding level as originally proposed. EU member states will also be able to place additional sustainability requirements on biomass fuels. By the end of 2026, the European Commission will assess the impact that those additional sustainability criteria may have on the internal market to ensure harmonization of sustainability criteria for biomass fuels.

A full copy of the report can be downloaded from the USDA FAS GAIN website.