Interview: Wind turbine ‘arms race’ must stop – Henrik Stiesdal and Andrew Garrad

Energy Disrupter

Manufacturers have introduced new turbines to the market at an increasing pace in recent years, with greater power ratings helping to cut project costs elsewhere or make more efficient use of limited space.

However, this has also prompted fears that ever-bigger machines are increasingly facing mechanical breakdowns or else making it harder for manufacturers to fully capitalise on one platform before it is replaced by another.

Wind sector pioneers Stiesdal and Garrad – who spoke to Windpower Monthly as they jointly won a top engineering prize – both argued that this ‘arms race’ should end.

Stiesdal (above) – who has served in senior research and technology roles at wind turbine giants Vestas and Siemens Gamesa – told Windpower Monthly: “If we had a maximum, then we could still innovate and compete within a certain boundary.

“I would hate to see one of the big western companies get in trouble because their turbine wasn’t sufficiently tested or because they needed to build too expensive factories to build small batches of turbines that will only be overtaken by the next generation.”

Meanwhile, Garrad – the founder of renewable energy consultancy Garrad Hassan (now part of DNV) – told Windpower Monthly: “Would I like them to stop getting bigger so fast? Yes, I would. I think it’d be better if we could spend time making them better and better rather than bigger and bigger.”

However, the two disagreed about who should make the decision on when and how to limit turbine sizes – for example, as a restriction on power rating or tip height.

Stiesdal told Windpower Monthly: “The wind turbine manufacturers can’t do this on their own, because if somebody else then makes a bigger machine – and the whole developer community has this habit of also always selecting the bigger machine on paper than the existing one that exists as hardware – then you lose if you are the only one who doesn’t want to continue the arms race.”

He argued that the push should come from politicians, and added: “You can easily live with some external limits to what you do. Other industries do that. And some industries have not had that external limit, but have just observed, ‘Oh, now we’ve got to be too big. We need to take a step back.’”

Airbus A380 at Manchester Airport (pic credit: Darren Moston/Getty Images)

Stiesdal added that in some industries, size ceased to be a commercial advantage, and so the cycle of ever-large products stopped. In commercial aviation, the Airbus A380 and Boeing 747 were discontinued with manufacturers reverting to smaller aircraft, while oil tankers peaked in size in the 1980s and then declined in size beyond that, Stiesdal noted.

“Nobody forced them to scale down; they did it because they couldn’t make money on the biggest machines anymore,” the Dane explained.

He added: “Do we really need to go up to something where we realise it was too big and then take a step back? Why don’t we play smart and say, ‘Let’s stop here and then get the extra earnings out of making it to mass production’.”

However, Garrad (above) disagreed.

He suggested that placing limits on “creativity and imagination” would be a “very dangerous thing to do”, and might reduce the engineering and cost benefits of larger turbines.

Garrad noted that in the past, his forecasts of the size of future turbines were “ridiculous”, and said: “It’s proved very difficult to estimate like that.”

He added: “If we look back 20-30 years, the idea that we could have ever had anything as big as [what we have now] is ludicrous.

“We might have said then, ‘For the [sake of the] landscape, we shouldn’t have anything bigger than 50 metres or so’.”

With such limits, the size of modern turbines would have been severely limited. “I think that would be unhealthy,” he concluded.

Instead, Garrad hopes for turbine sizes to reach a limit “naturally”, enabling manufacturers to focus on improving their designs.

“If it happened naturally, if all the manufacturers came together, and said, ‘Right, now I’d like to spend five years optimising this design and really making it as cheap as possible as efficiently as possible’, I would be delighted,” he added.

“But to artificially limit it, I think would be very, very much the wrong thing to do.”

East and west

Findings in a recent research paper by Wood Mackenzie suggest there might already be limits to the turbine ‘arms race’ – at least in the west.

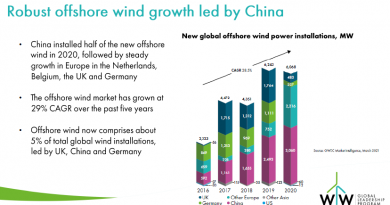

Endri Lico, principal analyst of the global wind supply chain and technology at Wood Mackenzie, noted that the average power ratings of turbines installed in China were greater than those in Europe last year, both onshore and offshore.

Onshore turbines in China averaged 5.4MW in 2023, while those in Europe had an average power rating of 5.1MW. Meanwhile, offshore turbines averaged 9.5MW in China, while those in Europe had an average power rating of 9.4MW.

Lico explained that western OEMs have slowed down the pace of new product introductions as they struggle financially, while their Chinese counterparts have not faced such pressures yet.

However, he warned that Chinese companies may eventually face the same squeeze: Chinese turbine prices dropped by more than 30% over the course of 2023, “indicating that a profit crunch may be looming for Chinese wind companies”, he wrote.

Additionally, turbines introduced by western companies in the past five years have struggled to reach the manufacturing economies of scale needed to deliver value, he argued. New turbines require significant capital expenses in research and development, as well as heavy supply chain investment for larger components – all of which must translate into greater revenues for the turbine platforms to be profitable.