Pulpwood Price Drivers and Mill Curtailments

Energy Disrupter

Regional differences in fiber prices are as great as they have ever been.

ADVERTISEMENT

Fiber prices rose to record levels in the U.S. Northeast and West in Q4 2022. Labor availability factored into higher prices in both regions. A lack of logging capacity contributed to significant hardwood fiber scarcity in the Northeast, while a labor strike at Pacific Northwest Weyerhaeuser operations constrained softwood fiber availability there. The U.S. South remains a contrast as fiber prices largely fell. According to the Wood Fiber Review, regional differences in fiber prices are as great as they have ever been, with prices for roundwood and chips varying by 100% or more on some products between the highest and lowest average cost across North American regions.

The variance across regions speaks to how the physical profiles of mill capacity to forest supplies differ significantly. Two good examples are the performance of pulpwood prices in the South and rapid changes in fiber markets in Western Canada.

Pulpwood Price Drivers in the US South

The relationship between demand and supply of roundwood pulpwood and pricing is more complicated than sawtimber due to the availability of residual sawmill chips as a roundwood substitute. The rapid increase in southern lumber production over the past decade increased residual chip production, buffering pulpwood roundwood prices. To better understand price behavior, it is helpful to examine the dynamics of pulpwood pricing.

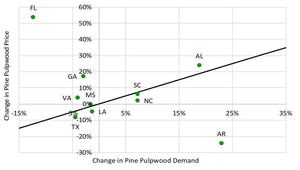

From 2015 through 2019, most southern states showed relatively small (less than 10%) changes in demand and price. Exceptions to this trend were Alabama, Arkansas, Mississippi and North Carolina. In these states, prices either fell despite minor drops in demand, or demand increased at a greater pace than prices. From 2019 through 2022, pulpwood prices increased 10% or more in three states, while demand increased a commensurate amount in only Alabama.

Comparing pulpwood price changes to demand changes from 2019 to 2022 reveals that fewer states appear to have a clear price response to demand changes (Figure 1). Instead, there are nearly as many states with negative relationships to demand as positive. Unlike the more straightforward relationship between demand and prices for sawlogs, pulpwood prices comprise a more complex web of relationships due to the roles of residual chips, oriented strand board demand and wood pellets, in addition to pulp markets and exports.

Curtailments: BC and Elsewhere

Since December 2022, announcements for sawmill curtailments and closings named over 20 mills in Western Canada (Alberta and British Columbia) and removed over 1.2 billion board feet of capacity from the sawmill sector. Firms including Aspen Planers, Canfor, Conifex, Interfor, Sinclair, Skeena, Tolko, West Frase and Western Forest Products announced curtailments as of February 2023 for Western Canada alone.

The pulp and paper sector also announced meaningful downtime, primarily in Western Canada and the U.S. South. In addition to the announcements tracked by Forisk, many mills ran below capacity. Softening demand for finished goods and the downstream impacts on raw material supplies from fewer available manufacturing residuals for pulp and paper mills are already affecting firms, especially in Western Canada. In short, declining production at regional sawmills affect the feedstock reliability and viability of regional wood-using pulp mills.

For the Northwest, there is a potential upside. A heavy portion of the curtailment activity occurs in B.C., which could, in effect, boost the need for regional production in Oregon and Washington. It will be interesting to see what 2023 brings for log prices and production levels in the Pacific Northwest.

This article includes data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber markets, and the Forisk Research Quarterly, which includes forest industry forecasts and analysis by sector.

Author: Brooks Mendell

Forisk Consulting LLC

770-725-8477

[email protected]