Washington Senate passes bill to establish SAF tax credits

Energy Disrupter

ADVERTISEMENT

The Washington State Senate on March 1 voted 46 to 2 in favor of a bill that aims to encourage the manufacture and purchase of sustainable aviation fuel (SAF) though tax incentives. The bill also directs Washington State University to convene a work group to further development of alternative jet fuels.

The bill, SB 5447, was introduced Jan. 18. Following its March 1 passage by the Washington Senate, the bill was transferred to the Washington House of Representatives. The House Committee on Environment and Energy is scheduled to hold a hearing to consider the legislation on March 9.

The bill requires the Washington State Department of Ecology, the agency tasked with implementing the state’s Clean Fuels Standard, to allow one or more carbon intensity (CI) pathways for alternative jet fuel. A summary of the legislation indicates that the department would be directed to allow biomethane to be claimed as a feedstock for renewable diesel and alternative jet fuel consistent with that allowable for compressed natural gas, liquefied natural gas, or hydrogen production.

The legislation also directs Washington State University to convene an Alternative Jet Fuels Work Group to further the development of alternative jet fuels as a productive industry in the state. The work group would be required to provide a report that includes pertinent recommendations to the government and appropriate legislative committees by Dec. 1, 2024. Additional reports would be required every two years until 2028, with the work group expiring Jan. 1, 2029.

Regarding tax incentives, the bill aims to create a preferential business and operations (B&O) tax rate of 0.275 percent for the manufacturing and wholesaling of alterative jet fuels. The B&O tax is Washington’s major business tax. According to a legislative documents, the B&O tax is imposed on the gross receipts of business activities conducted within the state, without any deduction for the cost of doing business. Some current B&O tax rates include 0.471 percent for retailing and 0.484 percent for manufacturing, wholesaling and extracting.

The bill would also establish a B&O and public utilities tax credit for certain sales and purchases of alternative jet fuel. The amount of the credit would be $1 per gallon of alterative jet fuel that has at least 50 percent less carbon dioxide equivalent emissions than conventional jet fuel. The credit would increase by 2 cents for each additional 1 percent reduction beyond 50 percent, with a cap of $2 per gallon. Eligibility for the credit for sales of alternative jet fuel would be limited to businesses located in a qualifying county or a businesses’ designated alternative jet fuel blender located in Washington. A qualifying county is a county that has a population of less than 650,000. The credits could only be earned on purchases of alternative jet fuel for flights departing Washington.

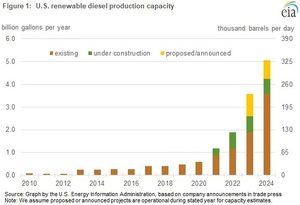

The tax incentives would begin after there are one or more facilities operating within the state with a cumulative production capacity of at least 20 MMgy of alternative jet fuel per year. The incentives would be in place for 10 years.

Washington Sen. Andy Billig has sponsored the bill. “Our state is already at the forefront of the aviation industry, and we should also be a leader in the development of cleaner fuels for those same airplanes,” he said in a statement. “This is a market just waiting to be tapped. There are potentially hundreds of family wage jobs and wonderful opportunities for businesses in this emerging industry, and we’re just now scratching the surface.”

Additional information on the bill is available on the Washington State Legislature website.