Google, Meta and Amazon lead on US renewable energy consumption – report

Energy Disrupter

By the end of 2022, 326 companies had contracted 77.4GW of clean energy, of which 28.8GW was generated by wind, according to an ACP report entitled ‘Clean Energy Powers Business’.

As much as 16% of all clean power generated in the US was flowing to corporate buyers by the end of last year.

In total, more than 200 corporations have signed contracts to receive energy from land-based wind projects and these contracts total 28.8GW, with 81% of that capacity currently operating and powering those business’ operations.

Pressure on corporates

“Economic and environmental benefits, as well as growing pressure on corporations to meet sustainability targets, have led to a 100-times increase in corporate clean power procurement over the past decade,” said JC Sandberg, ACP’s interim chief executive.

“During that same period, solar and wind costs have decreased 71% and 47% respectively, making both more attractive to corporate energy buyers. American companies are benefiting from – and contributing to – the affordability of clean power,” he added.

Wind now accounts for almost two-thirds of operating clean power capacity that is contracted to a corporate purchaser and across all companies, more than half have more wind than solar, according to the report.

Sectors most reliant on wind

Specifically, wind accounts for 37% of total clean power capacity contracted by businesses in the US, and 65% of the contracted capacity that is currently operational. The industry sectors which rely on wind power the most are consumer goods, financial and advisory, and retail.

This is despite power purchase agreements (PPAs) for wind increasing by some 37% year over year compared with 30% for solar, said the report. At $49.66/MWh, national average corporate wind PPA prices have increased by 11% since the second quarter of 2022.

Biggest buyers of wind power

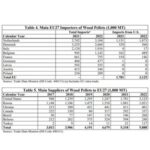

Google takes the top spot for total contracted and operating wind capacity. The search engine company accounts for 10% of total wind capacity with a corporate buyer alone. It is also the leader for operating contracted wind capacity, with 83% of its contracted capacity operating, compared to 69% of Meta’s contracted capacity.

Even so, Meta – the parent company of Facebook – is a close second; only 170MW behind Google and with 2.6GW of wind capacity contracted.

Amazon is the only other corporate entity with more than 2GW of wind capacity contracted. The online retail giant has contracted 2.2GW of wind capacity in the US, 77% of which is currently operating.

Wind plus storage projects, generally less common than solar plus storage projects, have attracted fewer corporate buyers.

However, so far 12 corporations have contracted 548MW from wind plus storage hybrid projects. These contracts relate to three projects: Casa Mesa, High Lonesome Hybrid, and Azure Sky Wind + Storage.

Solar steals a march on wind

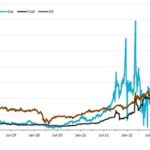

Despite wind’s head start, solar is currently of more interest than wind, allowing corporate buyers to balance their portfolios after years of wind-focused procurement.

Solar procurement announcements grew rapidly from 2017 to 2022 and reached a new high in 2022 at 14.4GW. By comparison, only 576MW of solar capacity procurement was announced in 2017.

Until 2018, wind was the first choice for corporate buyers but since then, commercial and industrial companies have decreased their wind energy procurement by an average of 18% each year through 2021.

Wind made up the majority of contracted capacity from 2010 to 2018 and accounted for more than 95% of announcements from 2010 to 2014, before it fell to 60% in 2018.

Wind’s comeback?

In 2022, corporate wind procurement resurged slightly, increasing by 25% compared with 2021 to 4GW of new wind offtake announcements.

Currently, no corporations have offtake agreements for offshore wind in the US, according to the report.

It said that a typical wind project repays its carbon footprint in approximately six months, and then provides decades of emissions-free energy.