EPA’s RFS ‘set’ rule boosts RVOs through 2025, addresses eRINs

Energy Disrupter

<img src="https://biomassmagazine.com/uploads/posts/web/2022/12/resize/RFSProposedRVO2023_25_2_16699275856505-300×300-noup.jpg" title="SOURCE: U.S. EPA

</small>”>

<img src="https://biomassmagazine.com/uploads/posts/web/2022/12/resize/RFSProposedRVO2023_25_1_16699275856829-300×300-noup.jpg" title="SOURCE: U.S. EPA

</small>”>

ADVERTISEMENT

The U.S. EPA on Dec. 1 released its long-awaited Renewable Fuel Standard “set” rule, which includes renewable volume obligations (RVOs) for 2023, 2024 and 2025. The proposed rule also expands the program beyond liquid fuels to include certain types of renewable electricity used to fuel cars.

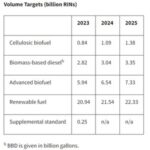

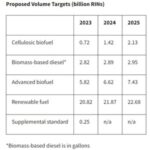

The proposed rule sets the 2023, 2024 and 2025 RVOs at 20.82 billion gallons, 21.87 billion gallons, and 22.68 billion gallons, respectively. A 250-million-gallon supplemental obligation would also be imposed for 2023. That supplemental obligation aims to address remand of the 2014-2016 annal rule by the D.C. Circuit Court of Appeals in Americans for Clean Energy v. EPA. A similar 250-million-gallon supplemental obligation was implemented for compliance year 2022.

The RFS program was originally established by the Energy Policy Act of 2005 and expanded to its current form under the Energy Independence and Security Act of 2007. EISA included statutory RVO targets set by lawmakers through 2022. Starting in 2023, the EPA is given more discretion in setting annual RVOs. The “set” rule released today marks the first time the agency has been able to use that discretion. Many biofuel groups are applauding the EPA’s proposal which aims to boost biofuel blending by an impressive 2.05 billion gallons between 2022 and 2025, with substantial increases for cellulosic biofuels, and advanced biofuels. Groups representing the biodiesel, renewable diesel and sustainable aviation fuel (SAF) industries, however, are criticizing the proposal for failing to properly account for expected growth in these fuels.

For 2023, the EPA has proposed to set the total RVO at 20.82 billion gallons, up 190 million gallons when compared to the 2022 RVO finalized earlier this year. The 2023 blend target includes the nested requirements of 720 million gallons of cellulosic fuel, 2.82 billion gallons of biomass-based diesel and 5.82 billion gallons of advanced biofuel. Conventional biofuels, such as corn ethanol, could fill up to 15 billion gallons of the RVO requirement. The 250-million-gallon supplemental obligation boosts the total 2023 obligation to 21.07 billion gallons.

For 2024, the EPA is proposing to increase the total RVO by 1.05 billion gallons to 21.87 billion gallons, including 1.42 billion gallons of cellulosic biofuel, 2.89 billion gallons of biomass-based diesel, and 6.62 billion gallons of advanced biofuel. Those nested requirements would allow for up to 15.25 billion gallons of conventional biofuel to be used to by obligated parties to fill their blend requirements.

For 2025, the agency proposes to increase blend obligations by an additional 810 million gallons to 22.68 billion. The nested RVO would include 2.13 billion gallons of cellulosic biofuel, 2.95 billion gallons of biomass-based diesel, and 7.43 billion gallons of advanced biofuel. The volume of conventional biofuels that can be used to meet RFS blend requirements would be maintained at 15.25 billion gallons.

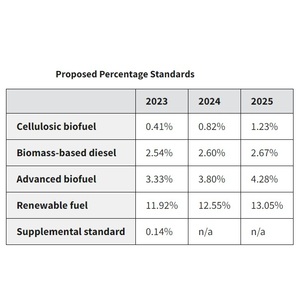

On a percentage basis, the 2022 RVO requires biofuels to account for 10.82 percent of transportation fuel. The RVOs for 2023, 2024 and 2025 would boost the biofuel blend levels to 11.92 percent, 12.55 percent and 13.05 percent respectively.

In the proposed rule, the EPA discusses its decision to address three RFS compliance years in the “set” rule and asks for public comments on whether it should also propose the 2026 RVO as part of the current rulemaking.

The agency said it believes that proposing volume targets for more than one year is appropriate, as it will provide the market with certainty of demand needed for longer-term business and investment plans. At the same time, the EPA said setting RVOs too far into the future can be difficult given the higher uncertainty associated with projecting supply for longer time periods and the increasing likelihood for unforeseen circumstances. “By proposing volume requirements for three years in this action but leaving the development of volume requirements for 2026 and beyond to a subsequent action, we believe we are striking a reasonable balance between certainty in our projections and providing certainty for investment,” the EPA said. “Nevertheless, recognizing that many regulated parties would appreciate knowing the applicable standards for as many years as is reasonably possible, we are requesting comment on establishing standards for 2026 in addition to 2023–2025 through this rulemaking.”

The proposed “set” rule also includes long-awaited regulatory provisions to allow renewable identification number (RINs) to be generated for renewable electricity used to fuel vehicles (eRINs). The proposed regulations address a wide range of issues, including which parties can generate eRINs, provisions to prevent double-counting, and data-requirements for valid eRIN generation. According to the agency, the regulations are intended to provide clarity on how electricity would be incorporated into the RFS. “We recognize that multiple stakeholders have expressed interest in the design of the regulations governing the generation of eRINs, and while this action proposes regulations to implement one chosen approach, this package also describes alternative approaches,” the EPA said in the proposed rule. “We welcome comments on both the proposed and alternative approaches.”

The EPA’s proposed approach for eRINs would allow vehicle original equipment manufacturers (OEMs) to generate eRINs based on the light-duty electric vehicles they sell by establishing contracts with parties that produce electricity from qualifying biogas. Under the proposal, eRINs would represent the quantity of renewable electricity determined to be used by both new and previously sold (legacy) light-duty vehicles for transportation, provided that sufficient renewable electricity has been produced and contracted by the OEM. The proposal would allow quantifying renewable electricity produced and put on a commercial electrical grid serving the conterminous U.S. to be contracted for eRIN generation so long as the OEM demonstrates that the vehicles it produced have used a corresponding quantity of electricity. Under the proposed approach, EPA would establish requirements for biogas generators and electricity producers, but only an OEM would be allowed to generate the eRIN, though the agency said the value of the eRIN would be expected to be distributed after its generation amongst multiple parties.

Alternative approaches discussed by the EPA include those allowing producers of renewable electricity to generate eRINs, allowing public access charging stations to generate eRINs, allowing independent third parties to generate eRINs, and a number of hybrid approaches that would allow multiple parties to generate eRINs.

The proposed rule specifies that qualifying renewable electricity under the RFS program must be generated from a feedstock that qualifies as renewable biomass under Clean Air Act Section 211(o)(1)(I). Other forms of renewable electricity, such as solar, wind and hydropower, do not qualify as renewable electricity or renewable fuel under the RFS program.

The EPA is also proposing to revise the equivalency value for renewable electricity in the RFS program from the current value of 22.6 kilowatt hours (kWh) per RIN (kWh/RIN) to 6.5 kWh/RIN. “We believe the change would more accurately represent the use of electricity as a transportation fuel relative to the production of biogas,” the agency said in the proposed rule.

The EPA is proposing for eRIN provisions of the rule to become effective starting on Jan. 1, 2024. The proposed cellulosic RVOs for 2024 and 2025 reflect the agency’s projected volumes for eRINs during those two compliance years.

The proposed rule, which spans nearly 700 pages, also includes a wide variety of other regulatory changes, including proposed enhancements to third-party oversight provisions; updated procedures for the apportionment of RINs when feedstocks qualifying for multiple RIN D-codes are converted to biogas simultaneously in an anaerobic digester; and revising the conversion factor in the formula for calculating the percentage standard for biobased diesel to reflect increasing production volumes of renewable diesel.

In addition, the proposed rule includes a list of specific questions related to the RFS and larger policy issues related to biofuels. The EPA is inviting public and stakeholder input related to these questions. Some examples include questions related to ways to incorporate the carbon intensity (CI) of each biofuel into the RFS program; ways the EPA can build upon policy investments included in the recently signed Inflation Reduction Act to further develop low-carbon renewable fuels; how the RFS can further support the development of sustainable aviation fuel (SAF); steps the EPA could take under the RFS to integrate carbon capture and storage (CCS) opportunities related to the production for renewable fuels; and steps the EPA could take under the RFS to capture opportunities related to hydrogen derived from renewable biomass.

A public comment period on the proposed rule is open through Feb. 10, 2023. A virtual public hearing is scheduled for Jan. 10, with the potential for an additional session to be held the following day if needed.

Representatives of the U.S. biofuels industry have generally spoken out in support of the rule, particularly for its treatment of conventional biofuels, cellulosic biofuels and eRINs. The agency, however, is being criticized for its treatment of biomass-based diesel RVOs, which stakeholders argue are far below currently predicted production volumes.

The RFS Power Coalition is commending the EPA for finally addressing eRINs. The coalition was formed in 2018 by Biomass Power Association, American Biogas Council and representatives of the waste-to-energy industry to advocate for the inclusion of renewable energy in the RFS. “This is a momentous day, nearly 15 years in the making. We are thrilled that the EPA included electricity in the RFS program,” said Carrie Annand, executive director of BPA. “This action ensures that low-carbon power for electric vehicles – a sizable and fast-growing part of the U.S. automotive sector – will continue to be available to reduce carbon emissions from transportation. It will also ensure that electricity generators are able to receive compensation for the valuable service they provide. We urge the EPA to review and approve the biomass and other pending pathways before the electricity program goes into effect in January 2024.”

“Biogas electricity producers are pleased about the inclusion of electricity in the RFS,” said Patrick Serfass, Executive director of the ABC. “Our members will finally be able to participate in the program, after waiting several years for responses on pending applications. We are encouraged by the proposed changes to the equivalency value, which will more accurately reflect the power being used by our nation’s electric fleet. That said, we are disappointed that the EPA does not allow the electricity producer to generate the RIN. This decision goes against years of precedent, and we are concerned this will adversely affect biogas producers.”

“With the inclusion of electricity in the RFS, resource recovery facilities will finally receive credit for the negative carbon fuel we provide for transportation every day,” said Tequila Smith, Covanta’s chief sustainability officer. “Many of the facilities we operate are owned by municipal governments, who have invested in the responsible disposal of municipal solid waste (MSW). We are excited to continue our work with the EPA to finalize pathway approval to fully participate in the eRIN market.”

The Renewable Fuels Association said the proposed rule creates a pathway for sustainable growth. “EPA’s proposed rule solidifies a role for the Renewable Fuel Standard in future efforts to reduce carbon emissions and enhance our nation’s energy security,” said Geoff Cooper, president and CEO of the RFA. “Once finalized, this rule will significantly accelerate growth and investment in the low-carbon renewable fuels that will help decarbonize our nation’s transportation sector, extend domestic fuel supplies, and bolster the rural economy. By including three years’ worth of RFS volumes, EPA’s proposed rule will finally provide certainty and stability for the entire supply chain. EPA Administrator Michael Regan put the RFS program back on track with the 2022 volume obligations, and today’s proposal builds upon that solid foundation. RFA thanks Administrator Regan and the Biden administration for continuing to make good on their commitment to grow the marketplace for lower-carbon, lower-cost renewable fuels.”

The American Coalition for Ethanol commended EPA for its rule, noting the agency is getting the RFS back on track. “This proposed rule is a critical opportunity for EPA to leverage the greenhouse gas reducing benefits of increasing biofuel blending targets by getting the RFS back on track, and we’re pleased the agency is taking steps in the right direction by setting conventional biofuel blending at 15 billion gallons or more for 2023 through 2025 on paper, in addition to including the 250 million gallons of supplemental volume to carry out the 2017 DC Circuit Court order,” said Brian Jennings, CEO of ACE. “Multi-year targets help provide clarity the market needs to lean into climate benefiting transportation fuels such as ethanol. The Inflation Reduction Act is poised to boost investments in clean fuel technologies that support the agency increasing the use of clean fuels like ethanol through RFS targets moving forward.

“Our comments to the proposal will emphasize the millions in biofuel infrastructure investments being made through the USDA that underscore the opportunity for expanded RFS targets for ethanol, as well as the long overdue need for EPA to formerly adopt the latest GREET model to determine the lifecycle GHG emissions of biofuel which continues to trend lower,” Jennings continued.

Growth Energy welcomed release of the proposed set rule, stressing it will help move the U.S. closer to reaching its net-zero goals. “We’re grateful to President Biden and EPA Administrator Regan for keeping clean energy on an upward trajectory that will move America closer to a net-zero future” said Emily Skor, CEO of Growth Energy. “As we saw again this summer, biofuels remain the single best tool available to shield motorists from volatile global oil prices and rapidly decarbonize the transportation sector. We are greatly encouraged by EPA’s strong proposal and appreciative of Administrator Regan’s support for the growing role ethanol continues to play in decarbonizing the transportation sector, now and into the future.”

“We’re also appreciative that the proposal restores the final 250 million gallons of biofuel demand that had been illegally waived in the agency’s 2016 rule – a long-overdue fix that began with 2022 volumes,” Skor added. “Moving forward, our opportunities for growth across both conventional and advanced biofuels are linked, so it’s important that EPA’s volumes must reflect industry growth and innovation – especially when it comes to the rapid expansion of renewable diesel.”

“We also must ensure that the final rule preserves the integrity of the RFS when it comes to new renewable fuel sources, like those tracked by e-RINs,” she said. “All new pathways must include safeguards to address double-counting, fraud risks, and other requirements to ensure that truly renewable energy is being harnessed to fuel our transportation needs.

“At the same time, the agency must clear the backlog of pathway approvals for advanced and cellulosic biofuels, including cellulosic biofuels from kernel fiber and advanced biofuels from corn oil produced at ethanol wet mills, and better leverage this opportunity to account for all of the innovation taking place in the renewable transportation industry,” Skor continued. “That will require updated modeling to reflect the best available science on low-carbon ethanol, including benefits of carbon capture technology and other innovations biofuel plants are deploying in the production of Sustainable Aviation Fuel.”

Clean Fuels Alliance America said the proposed rule woefully underestimates biomass-based diesel. “EPA’s overdue set proposal significantly undercounts existing biomass-based diesel production and fails to provide growth for investments the industry has already made in additional capacity, including for sustainable aviation fuel,” said Kurt Kovarik, president of Clean Fuels. “The volumes EPA is proposing for 2023, 2024 and 2025 ignore the more than 3 billion gallons currently in the market and fail to take into account the planned growth of the clean fuels sector.”

Clean Fuels referenced EPA’s data from the RFS program, which show that the U.S. market reached 3.1 billion gallons of biomass-based diesel in 2021 and already 2.9 billion gallons through October 2022, with two months still to go. The Energy Information Administration’s Short Term Energy Outlook, which informs EPA’s decisions on annual RFS volumes, currently projects a 500-million-gallon increase in biodiesel and renewable diesel consumption for 2023. EIA has also projected 2.4. billion gallons of added renewable diesel capacity coming online by 2024 and calculated another 1.8 billion gallons in announced planned capacity, according to Clean Fuels.

“The biodiesel and renewable diesel industry has already made considerable investments in production capacity and distribution infrastructure that will come online by 2025. The soybean and canola industries have invested more than $4 billion to bring additional feedstock capacity online over the next several years,” Kovarik continued. “EPA’s proposed biomass-based diesel volumes undercut those investments.”

The Advanced Biofuels Association is calling the “set” rule a missed opportunity for the expansion of advanced biofuels. “The EPA’s 2023, 2024, and 2025 Renewable Volume Obligations (RVO) are a missed opportunity to invest in and expand the adoption of low-carbon advanced biofuels,” said Michael McAdams, president of the ABFA. “While the EPA’s proposal provides much needed certainty for our industry, we are disappointed that the program has undervalued the advanced and biomass-based diesel pool.

“The Advanced Biofuels Association and our members believe in an all-of-the-above solution to our energy and climate challenges, inclusive of electrification and low-carbon advanced biofuels. However, the EPA’s proposed biofuel blending requirements do not fully reflect the volumes of advanced, biomass-based diesel, and cellulosic pools available in the market,” McAdams continued. “We look forward to reviewing the full details of the EPA’s proposal and working closely with the administration and other key stakeholder groups to make the vision of low carbon fuels of the future a reality.”

The Iowa Soybean Association and Iowa Biodiesel Board are voicing their concerns over the lackluster biodiesel growth proposed within the rule. “While we recognize that the EPA’s proposed 2022 Renewable Fuel Standard volumes include some growth for the biodiesel industry, by any measure it is very conservative growth, and that will be detrimental,” said Dave Walton, director of the ISA and IBB. “The 60 million gallons of RFS volume growth proposed by EPA for 2023, for example, is a far cry from what other agencies are projecting to come online. The Energy Information Administration predicts 500 million gallons of added biodiesel and renewable diesel in 2023. EPA should take that into account.

“Frankly this small increase in growth would send negative signals to the market. Significant investments have been made in feedstock infrastructure, like soybean crushing plants, and the administration would undercut that,” Walton continued. “Iowa’s 11 biodiesel plants, which have a proven history of generating economic growth and jobs while reducing the nation’s carbon footprint, also stand to lose under this proposal. That means our state’s rural economy and Iowa soybean farmers, who rely on strong commodity demand to support their livelihoods, also come up short if this proposal is finalized.

“If decarbonization is truly a national priority, then biodiesel is one of the best technologies available to achieve that right now – not decades in the future. We will continue to work with EPA through this process in hopes that the agency will take a more forward-looking approach, and more aggressive growth, in the true spirt of the RFS,” Walton added.

The Iowa Renewable Fuels Association said the proposed rule set a solid foundation for the future of the RFS program, but needs to better account for rapid growth in advanced biofuels. “Today is our first peek into the new era of the RFS where EPA has more discretion,” said Monte Shaw, executive director of the IRFA. “As the finalized rule will set the foundation for this new era, it is more important than ever for EPA to get it right. They must lean into expanding the use of low carbon biofuels as Congress intended. The RFS should be, and always was intended to be, a market moving mechanism. From that viewpoint, today’s draft rule sets a solid foundation for conventional biofuels like ethanol. However, IRFA believes the final rule must better account for the rapid increase in advanced biofuels like biodiesel and renewable diesel. IRFA will work with EPA during this review process for improvements that will benefit consumers, farmers, and the environment.”

Additional information, including a full copy of the proposed rule, is available on the EPA website.