USDA maintains its forecast for soybean oil use in biofuel

Energy Disrupter

ADVERTISEMENT

The USDA maintained its forecast for 2022-’23 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 12. The 2022-’23 soybean outlook is for lower production and lower prices.

The USDA predicts 2022-’23 soybean production at 4.5 billion bushels, down 125 million bushels on lower harvested area. Harvested area, forecast at 87.5 million acres in the June 30 Acreage report, is down 2.6 million from last month. The soybean yield forecast is unchanged at 51.5 bushels per acre. With lower production partly offset by higher beginning stocks, 2022-’23 soybean supplies are reduced 125 million bushels. Soybean crush is reduced 10 million bushels reflecting a lower soybean meal export forecast. Soybean exports are reduced 65 million bushels to 2.14 billion on lower U.S. supplies, increased South American supplies, and lower global imports. With lower supplies only partly offset by reduced use, ending stocks for 2022-’23 are projected at 230 million bushels, down 50 million from the June forecast.

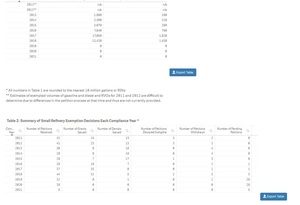

The USDA currently predicts 12 billion pounds of soybean oil will go to biofuel production in 2022-’23, a forecast maintained from the June WASDE. An estimated 10.7 billion bounds of soybean oil went to biofuel production in 2021-’22, up from 8.85 billion pounds in 2020-’21.

The U.S. season-average soybean price for 2022-’23 is forecast at $14.40 per bushel, down 30 cents from last month. The soybean meal price is projected at $390 per short ton, down $10. The soybean oil forecast is 69 cents per pound, down 1 cent.

Globally, the forecast for soybean production in Canada is lowered based on the latest plantings report from Statistics Canada. The 2022-’23 global soybean ending stocks are reduced slightly to 99.6 million tons as higher stocks for Argentina are more than offset by lower stocks for the U.S., Brazil and China. Notable changes for 2021-’22 include reduced soybean crush and imports for China, and increased soybean production, imports, crush and ending stocks for Argentina.