Could SGRE’s IP court battle with GE have implications for the entire wind industry?

Energy Disrupter

The battle of the titans may really only be getting started, with Siemens Gamesa Renewable Energy (SGRE) and General Electric (GE) duking it out over intellectual property (IP) in federal courts in the United States.

The companies may settle outside court but the fight has already been expensive and high-stakes.

Next up is a July 21 hearing in US District Court in Boston, Massachusetts at which damages payable by GE to SGRE will be discussed, according to a court official.

The case

In June, jurors found that GE must pay an unprecedented royalty fee – or damages – of $30,000 per megawatt for GE’s new Haliade-X wind turbine in the US because it uses technology covered by SGRE’s ‘413 patent.

The infringed patent is for an offshore direct-drive turbine’s structural support mechanism, and the physical and structural arrangement of the main shaft bearings. This allows the turbine to be larger so that it can handle increased loads and thus produce more energy, says SGRE.

The Haliade-X, with a 12-14MW capacity, is GE’s flagship offshore turbine. It is to be installed at the 800MW Vineyard Wind 1 Vineyard Wind 1 (800MW) Offshoreoff Martha’s Vineyard, Massachusetts, USA, North America Click to see full details project, under construction off Massachusetts and is due online in 2023. GE also has a framework agreement to provide Haliade-X turbines to Ørsted’s 120MW Skipjack Wind 1 Skipjack Wind 1 (120MW) Offshoreoff Ocean City, Maryland, USA, North America Click to see full details project off the coast of Maryland and 1100MW Ocean Wind 1 Ocean Wind 1 (1100MW) Offshoreoff Long Beach, New Jersey, USA, North America Click to see full details project off the coast of New Jersey.

The patent infringement could – at least in the short-term – shake up the offshore wind sector in the US.

$60m in royalties

Shashi Barla (pictured), director and head of research at Brinckmann Group, agreed that GE’s royalty payments – if upheld– could make the Haliade-X a “little bit uncompetitive.”

If GE is forced to pay a $30,000/MW royalty for its ‘backlog’ of just over 2GW of near-term projects, then it will face a $60m in IP expenses, Barla said, when its profit margin is already “very thin”.

Of GE’s aggressive stance regarding protecting its IP, he recalled that GE won fights with Vestas, Nordex and Mitsubishi. “Unfortunately, this time it backfired,” he said. “It’s kind of shooting themselves in the foot.”

Negative signals

He lamented the IP fight, saying it “sends a negative signal” from the wind industry and that investors and developers “could get cold feet.” The fight is especially risky because there are only three major offshore turbine suppliers globally, excluding China, he said. “It is a huge supply risk for the industry if GE and Siemens fight,” he said.

Barla said: “These kind of [IP] challenges will delay the energy transition, whereas we should accelerate the energy transition.”

However, Barla said GE will be thinking of the next generation of offshore technology, which he estimated could be finalised in up to 12 months and installed commercially by about 2026, or even 2025 if GE is aggressive.

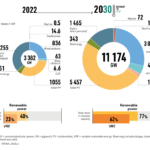

Another positive for GE, Barla said, is that of the 30GW of US offshore wind that Biden is pushing for by 2030, 25GW is not scheduled for commissioning until 2025-30.

Podcast: How will SGRE-GE court battle and Biden’s policy move affect US offshore wind?

The ‘776’

The Boston jurors also found that a different SGRE patent, the ‘776, was invalid. It is a broad and generic patent for an improved stator which helps to improve the turbine’s operation, cooling and maintenance, according to SGRE.

SGRE cannot now seek ‘reasonable royalties’ for use of the technology covered by the invalid patent, but it can appeal the jury verdict. “The patent is not necessarily dead in the water right now. All it means is that it cannot be asserted unless the jury’s verdict is reversed,” said Jared Hoggan (above), a patent litigator and partner at Munck Wilson Mandala in Dallas.

Grounds for appeal?

In fact, all parts of the verdict are appealable. Both parties are expected to appeal, but Hoggan added: “GE is more likely to appeal because Siemens could still walk away without an appeal with a very significant win.”

Appeals tend to be relatively cheap, compared with a jury trial, said Paul Morico, sector chair of IP at the Baker Botts law firm in Houston who has advised the transition team of President Joe Biden on IP-related issues. A jury trial might cost 80% of a total bill, whereas an appeal may only cost 20%, he said.

Morico estimated that legal costs for each party so far in the case will be “north of $10 million”.

Another issue that could be broached at the July 21 hearing is SGRE’s argument for a permanent injunction for any further infringement by GE. Nor did jurors, in their May 19 verdict, comment on when exactly the $30,000/MW royalty would become payable. GE licences, for example, typically specify a one-time fee payable within 90 days of a turbine’s commissioning.

An expert had previously speculated that Judge William Young could address the issue of whether SGRE is obliged to license the infringed technology to GE, but that is unlikely because compulsory licencing does not exist in the US.

“GE is kind of at the mercy of Siemens – there’s no obligation for a compulsory licence,” said Morico.

Application of patent law

A notable aspect of the IP dispute during the trial was Judge Young’s ruling backing SGRE’s argument that US patent law applies to offshore wind technology, even when projects are located beyond American territorial waters but within 200 nautical miles (370km) of the coast. The ruling was because the wind turbines are fixed to the Outer Continental Shelf (OCS).

The multi-billion-dollar OCS ruling could impact the entire current US offshore wind pipeline of 60GW, since almost all of the offshore wind pipeline in the US is on the OCS. GE has already told the court that it will appeal. A typical appeal takes 18 months, said Morico, adding that the ruling on the OCS could end up at the US Supreme Court.

Professor Elizabeth Winston (pictured) of Columbus Law School at the Catholic University of America said the OCS ruling is no surprise, and is in line with how law is applied in other countries including the UK.

Asked how the OCS ruling could impact offshore wind projects in states other than Massachusetts, she said: “A Massachusetts district court decision is not binding on a district court in another jurisdiction, but may be found to be persuasive by another district court.”

Since last month’s verdict, GE has declined to comment on the case, while an SGRE spokesman said: “Siemens Gamesa is currently evaluating all options and no decision has been made at this time regarding either the injunction or the appeal.”