India needs $223 billion to meet 2030 renewables targets

Energy Disrupter

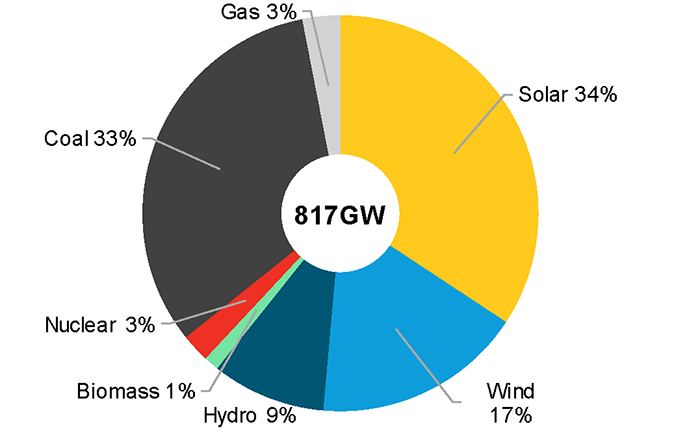

India requires $223 billion of investment in 2022-2029 to meet its 2030 targets for wind and solar capacity, according to a new report by BloombergNEF (BNEF). The country wants 50% of its electricity demand to be met by renewable energy by 2030, aiming for 500GW of non-fossil power generation, including 140GW (17%) of wind power and 280GW (34%) of solar.

By end-2021, 165GW of zero-carbon generation had already been installed in India. BNEF’s Financing India’s 2030 Renewables Ambition report, published in association with the Power Foundation of India, says corporate commitments from Indian companies could potentially help the country achieve 86% of its 500GW by 2030 goal.

Shantanu Jaiswal, lead author of the report and head of India research at BNEF, said: “To date the growth of renewable energy in India has been funded by a diverse set of financiers. Debt and equity structures have evolved as the market grew and new risks emerged. India’s ambitious renewable energy targets now require further scaling up of financing with new instruments and learnings from other global markets.”

Earlier in June, India’s government outlined plans for annual gigawatt-scale offshore wind auctions, with the first round to be launched later this year. However, the report says the scaling up of renewables in India faces regulatory, project and financing risks, with power purchase agreement (PPA) renegotiation, land acquisition and payment delays cited as key risks by industry stakeholders surveyed by BNEF. In the short term, rising interest rates, a depreciating rupee and high inflation create challenges for the financing of renewables.

“Scaling up financing to meet 2030 goals requires independent power producers to tap into new or underutilised sources of capital,” said Rohit Gadre, an analyst in BNEF’s India research team. “These could [involve] construction debt, investment infrastructure trusts and funding from retail investors, insurance companies and pension funds.

“Higher funding requirements also need measures that can increase the availability of financing, such as derisking renewable projects to offering contractual terms that provide greater comfort to investors.”

Investment in grid and transmission networks to the tune of $175 billion between 2020 and 2029 are also required to support new capacity additions and reinforce existing networks.