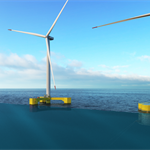

Spain focuses on floating wind in 3GW offshore plan

Energy Disrupter

Spain’s central government has passed its national offshore wind power roadmap, rubber stamping a 1GW-3GW objective for installed capacity by 2030

Floating offshore wind would likely make up the majority of this build-out. Spain has no operational commercial-scale offshore wind farms today.

The roadmap also ringfences a €200 million public support package for offshore research and development (R&D), prototypes and pilots to the end of 2023.

If the higher 3GW figure is reached, that would represent 5% of the EU’s 60GW offshore wind target for 2030.

While seemingly a modest ambition for a country with over 28GW of onshore wind, the 124-page route map focuses almost exclusively on the burgeoning market of floating wind technologies, making a virtue out of Spain’s extreme water depths close to its 7,600km coastline.

The roadmap’s stated aim is to make Spain “a European base and reference for R&D, design and demonstration” for floating wind technologies, “offering the best environment for testing new prototypes”.

The document recognises the Canary Islands as the springboard for floating technology, through that regional government’s so called Plocan programme – a platform 23km off the coast, where it plans to install 300MW of wind capacity by 2025, most of it floating.

The document also broadly outlines three other areas: the east coast, the southern tip either side of Gibraltar, and the northern Galician coast, where global offshore wind major Iberdrola is developing a 980MW floating project.

While positive, the response from national wind association AEE was not jubilant, mainly because details in the roadmap regarding specific development regulations and pay mechanisms remain to be set.

“Given a seven-year development timeline for offshore,” AEE calls for the announcement of specific offshore regulation to be brought forward to mid-2022 – from 2023 as stated in the roadmap – in order to reach the upper 2030 objective.

Meanwhile, the document does give a serious nod to power auctions as its only mention of pay mechanisms, highlighting how recent auctions have brought European offshore power prices down below €50/MWh, from over €200/MWh in 2015.

Other related measures pending include power line planning and interconnection regulation – expected for 2023 – together with a related maritime zoning plan, currently in public consultation, integrating floating wind platforms with fishing activities and maritime observatories.

Once all is in place, AEE expects a rapid response from a national industry that not only covers the entire wind power supply chain onshore but which, it claims, has also “equipped 11 of the world’s 13 floating wind power installations”.