Neste reports strong Q3 for renewables segment

Energy Disrupter

ADVERTISEMENT

Neste released third quarter financial results on Oct. 27, reporting that the company’s renewable products segment achieved high sales volumes and maintained healthy sales margins despite tight feedstock markets.

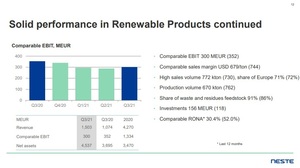

Peter Vanacker, president and CEO of Neste, said the renewable products segment posted a comparable operating profit of EUR 300 million for the period, down from EUR 352 million reported for the same quarter of last year. Sales volumes were up, reaching 772,000 metric tons despite scheduled maintenance performed at the Singapore refinery. Vanacker noted that scheduled maintenance was successfully completed slightly ahead of schedule. The company was able to maintain a healthy sales margin of $679 per ton as a result of successful sales performance and margin hedging, he added. Sales margin for the third quarter of last year was $744 per ton. Waste and residue inputs accounted for 91 percent of feedstock during the quarter, up from 86 percent during the same period of 2020.

According to Vanacker, renewables capacity expansion at the Singapore refinery is currently expected to startup before the end of the first quarter of 2023. That expansion project will increase renewable products capacity by 1.3 million metric tons per year, bringing Neste’s total renewables capacity to 4.5 million metric tons per year. The new production line will allow for the production of up to 1 million metric tons of sustainable aviation fuel (SAF) annually. Together with the company’s Rotterdam SAF optionality project, Vanacker said the company plans to have the capacity to produce 1.5 million metric tons of SAF annually by the end of 2023. Engineering work for additional capacity in Rotterdam is underway, he added, with an investment decision currently expected to be made in early 2022.

Moving into the fourth quarter of this year, Neste expects sales for renewable products to remain high. Waste and residue markets are expected to remain tight due to robust demand. Neste’s fourth quarter sales margin is expected to remain healthy based on the current feedstock and product market outlook. Renewables capacity utilization rate is expected to remain high, except for a scheduled four-week catalyst change at the Rotterdam facility.

Overall, Neste reported comparable operating profit of EUR 368 million for the third quarter, down slightly when compared to the EUR 373 million reported for the same period of last year. Operating profit was EUR 579 million, up from EUR 425 million.