Argentina seeks to unlock delayed wind farms

Energy Disrupter

Argentina is easing conditions on wind energy developers to unlock projects held up by the country’s long-running economic crisis.

Under a ruling issued 3 August by Energy Secretary Dario Martinez, developers will be given more time to complete construction of their wind energy projects awarded power purchase agreements under the Renovar series of renewable energy tenders. They will also be given discounts and facilities to pay fines for late completion.

Argentina’s power market operator Cammesa awarded contracts to buy power from almost 4.5GW of renewable energy projects in 2016 and 2018 during the first two Renovar rounds, including almost 2.5GW of wind energy.

While 2.7GW has now been developed, most of the remaining capacity has been held up by a lack of financing after Argentina’s financial crisis increased risk premiums to unsustainable levels.

Under the latest ruling, projects that are more than 70% complete will be able to request a 360-day delay of their deadline to begin supplying electricity to the grid during which time the daily fines will be reduced by up to 70%.

Developers will also be able to pay off penalties for the late completion of renewables projects in up to 12 monthly interest-free quotas. Alternatively, they can pay the fines over four years with a 1.7% interest rate, although with the condition that the fines cannot exceed 40% of the project’s monthly revenue.

The reduction in the penalties is designed to make it possible for developers to find financing for their projects to complete construction.

“It’s good but I don’t know if it’s enough. We will have to see as this ruling is implemented,” Hector Ruiz, general manager of the Argentinean Chamber of Wind Energy, told Windpower Monthly.

Policy gap

However, unlike a similar ruling issued earlier this year for renewables projects awarded contracts with private buyers, the ruling does not offer a way out for projects with little chance of being developed, which could represent up to two-thirds of the wind projects involved.

Unable to advance, these projects are blocking valuable transmission capacity on Argentina’s power grid which prevents other renewable projects from being developed in their place.

“This could lead to developers taking legal action over their situation,” said Ruiz.

Investor confidence?

Despite their country’s continuing economic difficulties, some Argentinean wind developers are returning to financial markets. On 3 August, Genneia, the country’s leading wind farm operator, announced the launch of its first green bond.

The issue will be exchanged for US$500 million worth of bonds which expire next year.

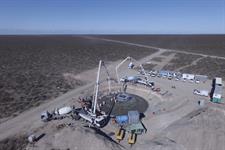

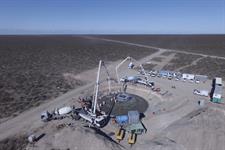

The US dollar-denominated bonds, which expire in August 2027, will be supported by electricity sales from its 70MW Puerto Madryn I Puerto Madryn I (70MW) OnshorePuerto Madryn, Chubut Province, Argentina, Central & South America Click to see full details and 150MW Puerto Madryn II Puerto Madryn II (150MW) OnshoreChubut Province, Argentina, Central & South America Click to see full details wind farms, the country’s largest. The company achieved a yield of 8.75%

“For Genneia, it is truly an honour to offer a proposal with these characteristics to its investors,” said CFO Carlos Palazon.

Last month, a group of bondholders for the Argentinean province of La Rioja accused the provincial government of needlessly defaulting on its green bond, which is supported by revenue from its 100MW Arauco Arauco (100MW) OnshoreTubul-Raqui; provincia de Arauco, Biobío, Chile, Central & South America Click to see full details wind farm, despite rising tax revenues and increased public investment.