Covanta provides update of UK waste-to-energy projects

Energy Disrupter

ADVERTISEMENT

Officials from Covanta Holding Corp. discussed the company’s ongoing strategic review and provided an update on the development of the company’s U.K. waste-to-energy projects during a first quarter earnings call, held April 30.

Michael Ranger, president and CEO of Covanta, opened the call with a discussion of the strategic review, which was announced earlier this year. “When we talked in February, I described the scope of our initial review, which aimed to identify each of the fundamental elements of our business and assess how we could unlock value,” he said. “We have now completed that initial review and I am even more confident that the underlying value is there and it is substantial. Our plan is now in motion.”

Ranger explained, that at the macro level, the strategic review has clarified that Covanta’s business has four principal components. The first component is the company’s 21 waste-to-energy plants in North America, which are 100 percent owned by Covanta and benefit from long-term contracted waste supply and strong local waste markets. “As a group, they represent the vast majority of the value of our business as configured today,” he said.

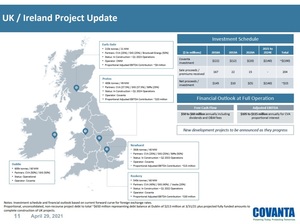

The second component is the Irish and U.K. waste-to-energy business, Ranger said. Those plants are owned in partnership with financial and waste industry participants. “Both the Irish and U.K. markets are much more favorable than North America in terms of waste and energy pricing and policy support,” Ranger said. “When the U.K. plants go into operation, we will have a new fleet of waste-to-energy plants in these markets. And as a group, they will make a meaningful contribution to both our near-term results and growing future equity value.”

Covanta’s environmental solutions business is the third main component, and the fourth is the 18 waste-to-energy plants in North America that are owned by the public sector but operated by Covanta. While some of those waste-to-energy projects are profitable, as a group they are contractually and financially challenged, Ranger said. “We are developing plans to improve the value they represent through renegotiations and expirations,” he added.

A part of Covanta’s strategic focus is to improve the cash flow contribution of financially challenged operations, Ranger said. If the company sees no clear path to do so, those operations will be closed down, he added. “We have now identified a number of sites where we intend to shut our operations over the next several years, including several public sector operating contracts where we have already notified our clients that we do not intend to extend contracts when they expire,” Ranger said. “And, at the same time, we are in active negotiations with other public sector clients to negotiate contract extensions on improved terms.”

Ranger also provided an update of the company’s U.K. waste-to-energy projects. Through its partnership with the Green Investment Group, Ranger said Covanta has moved four projects into construction. Those projects have a combined 1.5 million metric tons of waste processing capacity. “Construction has proceeded remarkably well across this portfolio, especially considering the challenges presented by both Brexit and the pandemic,” Ranger said. “This achievement now positions us to transition to a valuable operating business in the U.K. generating significant financial contribution from these four projects. Where we’re getting that transition and by early 2024 we will have, when coupled with our Dublin project, five new assets operating in one of the best markets in the world in terms of waste pricing and policy support.

“Our Rookery project will be the first to move into operations,” he added. “We expect it will begin receiving waste within weeks. And we are commissioning the plant now with full commercial operations early in 2022…Beyond Rookery, our other projects now under construction will enter operations sequentially through early 2024.” Specifically, Ranger said the Earls Gate project is expected to begin operations in the first quarter of 2023, while Newhurst is expected to begin operations in the second quarter of 2023 and Protos is expected to begin operations in the first quarter of 2024.

Covanta reported revenue of $498 million for the first quarter of 2020, up from $468 million during the same period of last year. Net income was $2 million, compared to a net loss of $32 million. Adjusted EBITDA was $106 million, up from $97 million during the first quarter of 2020.

Additional information is available on the Covanta website.