GE Renewable Energy narrows losses in Q1 2021

Energy Disrupter

GE Renewable Energy narrowed its losses in the first quarter of 2021, with orders and revenue up within the division.

Losses in the segment were $234 million in the first three months of the year, an improvement on the $327 million it lost in the same period in 2020.

The US giant’s renewable energy division reported some large orders for onshore wind and high-voltage direct-current (HVDC) transmission systems for offshore wind.

It also announced plans for a new offshore wind blade plant in the UK and an expansion to its turbine repair centre in Spain.

The unit’s orders increased 15% year on year to $3.5 billion in the first three months of 2021, driven by an order to build the HVDC system for RWE’s Sofia wind farm, and, to a lesser extent, by onshore and offshore wind service deals. It also received an order to supply a 1.5GW wind cluster in Oklahoma – its largest onshore wind project to date.

The company’s revenues inched up 2% to $3.25 billion in the first quarter, as it delivered more than 760 new onshore turbines in the first three months of the year.

However, revenues for onshore wind services were down as it did not deliver any repowering upgrades, the manufacturer stated.

GE Renewable Energy CEO Jérôme Pécresse added that he expects the US’s onshore wind market to stay at “quite a high level” and championed US offshore wind as “the next big thing”.

He said: “The Biden administration is taking a strong stance in accelerating the permitting of the first offshore wind projects, and that will allow total wind installed in the US — onshore plus offshore — to stay at a very strong level in the years to come.”

Onshore wind

In a conference call, chief financial officer Carolina Dybeck Happe told reporters that GE expects the onshore wind sector to fall slightly in the US, while there would be “robust growth” globally. Accordingly, in its results presentation, GE plans to expand its international onshore activities, but did not give any further details.

However, GE has recently received some large onshore wind orders in Spain, and installed about half of the 1.7GW added in the county last year, according to Spanish wind association AEE. GE also announced plans to expand its blade repair facility in Spain – a move it stated “demonstrates strong demnd for repair and refurbishment work in the country and region”.

Happe added that GE expects the global offshore wind market to experience strong growth throughout the decade.

GE chief executive Larry Culp added that the company’s renewable energy unit would be more selective when pursuing projects – especially in the areas of onshore wind and grid, where it has been profitable.

“What we see happening in onshore wind, and increasingly in grids, is a little less of an aggressive pursuit of the top line (orders and revenue), but a more balanced approach,” Culp explained.

“We are in a good position where we can make money (from onshore and grids), and maybe more over time, but have a better risk profile to make sure we are in the geographies where we have higher competence. It is a practice we are driving across the company.”

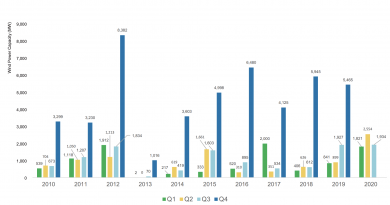

GE Renewable Energy recorded a full-year loss of $715 million in 2020 – compared with a $791 million loss one year earlier. This came despite it recording its first quarterly profit since 2018 in Q3.