Making the numbers work for a residential energy storage system – pv magazine USA

Energy Disrupter

Let’s be blunt: In most states, adding batteries to a residential solar system will significantly slow down the payback period.

According to five-year-old Census data, around 18.3% of homes claim to have home generators. Those generators require maintenance and fuel, and they only pay off if you are served by a rural power grid or live in a disaster-prone area.

That must mean there is more value in residential battery backup systems than a simple return on investment calculation can show. And, after recent grid events in Texas and California, the value of a battery backup is impossible to ignore.

Michelle Davis from WoodMac Renewables & Power said that 7% of residential solar capacity was paired with storage in 2020. She said that growth rate is on track to more than double in 2021, to 16%.

Anecdotal evidence in “hot markets” suggests this value could be closer to 60% if batteries were available. Hawaii practically requires energy storage, because residents there may not export excess solar power to the grid.

Most residential solar+energy storage is not financially viable for two main reasons.

The growing installation base of residential batteries comports with prior surveys suggesting that nearly 75% of consumers interested in solar also have a strong interest in energy storage.

Viable?

However, most residential solar+energy storage is not financially viable for two main reasons.

First, most solar installations occur in states where net metering is allowed. And since net metering enters a credit for excess daytime generation to a homeowner’s electricity account, there really isn’t a financial motivation to install batteries and store that electricity.

Second, there really isn’t any other path for a single home’s energy storage to make money. For instance, it was only two years ago that Sunrun won the rights for 5,000 residential solar+storage systems to participate in the New England ISO wholesale marketplace. Thus, for most people in most states, energy storage is an emotional purchase, based on a consumer’s confidence (or lack thereof) in their power grid’s resilience.

In key markets – without a doubt – energy storage is worth some money.

For example, in Massachusetts, two programs support residential energy storage economics. The first is the SMART program. We’ve covered how solar is paid handsomely in the Bay State; this same program also pays homeowners to couple batteries with solar.

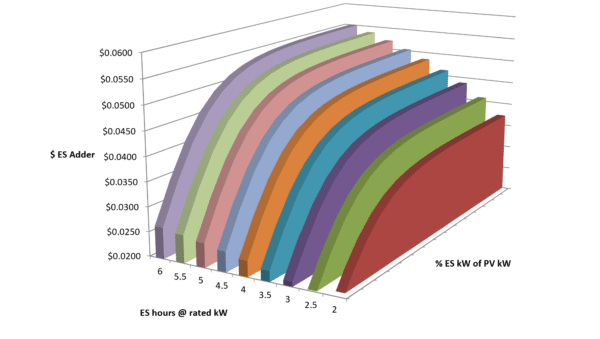

The above image is from the state’s Energy Storage Calculator. Roughly, this depicts the outcome of an equation that calculates your energy storage incentive. The underlying data are in the table below.

The equation is based on the ratio of energy storage system size to solar system size. The state first looks at the ratio of your system’s solar panels to its battery inverter sizing, and then looks at the number of hours that the battery can output energy at that rate.

For example, a standard Tesla Powerwall that is 5 kW/13.5 kWh when installed with a 10 kWdc solar system would add around 3.8¢/kWh to the standard incentive price. This number is rough as there are other equipment nuances, but close enough. So, if a 10 kWdc residential solar system generates 12,000 kWh in a year, the customer stands to earn an additional $456/year.

But, when we consider the install price of roughly $12,500 for most Tesla Powerwall systems and subtract the 30% tax credit, that leaves a 19+ year payback. This does not “pencil.”

The second Massachusetts program is known as Connected Solutions. Here, solar homeowners are paid to allow the utility to use their battery to manage power grid peak demand moments. Vermont’s Green Mountain Power first figured this out, and they have saved state electricity payers millions of dollars over the years, all while offering home resilience.

The program offers homeowners a potential return of $1,375 per year. Combine that with the above SMART incentive cash and the payback period is shortened to 4.7 years. Now we’re cooking with electricity!

A desert ripe for growth

Beyond the SMART program, the markets where batteries make financial sense become scarce quickly.

As mentioned, Hawaii’s rate structure – no net metering and no export of electricity to the power grid – forces energy storage onto homeowners. Coupled with a high price of electricity, residential storage makes sense there.

California’s SGIP energy storage incentive program strongly supported residential energy storage, at least for a while. However, because of heightened concerns over wildfires, it is in extremely high demand and quickly running out of cash. Shifting residential solar installations into a “time of use model” marginally helps the financials, but not enough.

Enter Sunnova’s SunSafe offering and various other residential solar lease companies. While this author prefers a home energy generation ownership society, it’s hard to argue with Sunnova’s approach: No money down (typically), 25 years of operations and maintenance, and low interest rates.

Let’s be blunt one more time: For Texans who were without heat and power during the multi-day mid-February blackout that killed 200 people, our financial viability calculations for energy storage go straight into the trash.

John Fitzgerald Weaver is a solar power professional, known digitally as the ‘Commercial Solar Guy.’ His company has a construction license in Massachusetts, and directly manages projects in MA & RI. He may be reached at commercialsolarguy@gmail.com.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Original Source: https://pv-magazine-usa.com/2021/04/06/making-the-numbers-work-for-a-residential-energy-storage-system/