Siemens Gamesa to overtake Vestas by 2025

Energy Disrupter

The world’s top three wind turbine manufacturers – Vestas, Siemens Gamesa Renewable Energy and GE Renewable Energy – are due to increase their combined global market share in the next ten years, according to new research.

Analysts at Wood Mackenzie believe these three manufacturers will increase their global market share from 43% in 2019 to 60% in 2029, with Siemens Gamesa leapfrogging Vestas into top spot by 2025.

They will benefit from their global operational scale, onshore and offshore presence, large balance sheets, closer proximity to the largest asset owners and financial strength, the analysts explained.

Meanwhile, Germany-based Nordex has emerged as a contender for fourth spot in global markets — excluding China — as compatriot Enercon suffers financial troubles and completes a transformation programme. Wood Mackenzie expects Nordex to have the fifth highest cumulative installation capacity by 2029.

| 2019 | 2029 forecast |

| Vestas | Siemens Gamesa |

| Siemens Gamesa | Vestas |

| GE | GE |

| Goldwind | Goldwind |

| Envision | Nordex |

| Mingyang | MingYang |

| Nordex | Envision |

| Windey | Sewind |

| Enercon | Suzlon |

| Sewind | Dongfang |

Wood Mackenzie’s rankings for turbine manufacturers’ cumulative installed capacity in 2019 and forecast for 2029

Global outlook

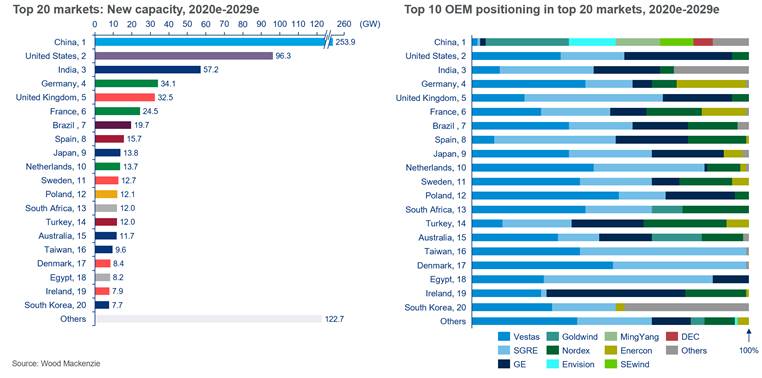

European manufacturers take the top four positions in Wood Mackenzie’s forecast despite China – where westerners have typically been less successful – being projected to add the most capacity between 2020 and 2029.

The top ten is to be completed by Goldwind, Nordex, MingYang, Envision, Sewind, Suzlon and Dongfang Electric Corporation (DEC), the analysts forecast.

Wood Mackenzie expects China to add 253.9GW of wind capacity in the next ten years, ahead of the United States (96.3GW), India (57.2GW), Germany (34.1GW) and the UK (32.5GW).

The analysts believe the top eight global wind turbine OEMs will more than double their cumulative installations this decade.

Vestas and Siemens Gamesa will each surpass 200GW of installed capacity by 2029, while GE is likely to be 12GW shy of that number.

Meanwhile, Wood Mackenzie forecasts Goldwind to be the only Chinese manufacturer to breach the 100GW mark by 2029.

Western turbine manufacturers will also gain greater footing in China, the analysts believe.

Shashi Barla, principal analyst at Wood Mackenzie, said: “Western turbine OEMs are expected to capture more than 10% of combined market share in China this year – the highest in the past decade – due to the feed-in tariff (FIT) termination.

“FIT phase-out in China has triggered a near-term surge in the market, with tier-two players climbing the 2020 rankings. China’s aim to meet the 2060 carbon-neutral goal may entice new entrants into the wind industry due to a significant increase in demand.

“Tier-two Chinese domestics players are targeting the offshore market with 10MW-plus turbines, while the mainstream players look to 5-7MW technologies to strengthen their share.”