Enel looks to triple renewables capacity by 2030

Energy Disrupter

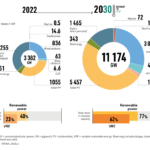

Enel aims to increase its consolidated renewables capacity by about one third in the next three years and nearly threefold in the next decade, as it bolsters its role as a green “supermajor”.

According to a 2021-23 strategic plan and 2030 vision, presented today (24 November), the company expects to invest about €17 billion to boost renewables capacity from 45GW now to about 60GW in 2023.

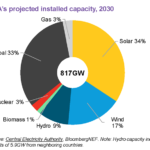

In the longer term, the company plans to invest a total of about €70 billion in renewable energy in the next decade to bring total renewables capacity to 120GW, as it taps into a pipeline of over 140GW in projects.

While new capacity is expected to be “well balanced” between wind and solar, chief financial officer Alberto De Paoli said in a presentation on Enel’s plans that investments earmarked in its strategic plan are not set in stone and could be adjusted based on the profitability of projects.

Coal out, green hydrogen in

The company is also bringing forward the exit date for its coal power production to 2027 from 2030 and now envisions that its greenhouse gas emissions will be 80% lower than their 2017 level in 2030, on its way to full decarbonisation in 2050.

Enel also expects to have more than 2GW in green hydrogen projects in 2030, with roughly 120MW realised by 2023. It is currently developing green hydrogen projects in Chile, the US, Spain and Italy.

It intends to invest €5 billion in the “hybridisation” of renewable energy projects with battery storage, with potential for 20TWh by 2030.

In terms of locations, in the next three years Enel expects to see growth in renewables focused on Europe, Latin America and the US.

The company expects to concentrate on bolstering its owned fleet of renewable assets in specific markets where it has an integrated presence and is also active in the distribution of electricity.

Aside from boosting its own fleet of renewable assets, Enel anticipates further renewable capacity — which it operates but does not own — to increase to 25GW in 2030 from around 4GW now. It expects to add 4.1GW in managed capacity in the next three years, mainly in Asia Pacific and Africa.

While US president-elect Joe Biden’s pledge to rejoin the Paris Agreement “will have an important psychological impact,” Enel CEO Francesco Starace said he doesn’t believe his election will result in any “major change for the worse or better” for growth in renewables in that market.

“Through Bush, Obama and Trump, the growth in renewables has been fairly constant due to the policies enacted in the individual states,” he noted. The US market also benefits from the “most efficient” authorisation process worldwide, Starace added.

‘Inefficient and complex authorisation process’

Speeding up the authorisation process will be key for Europe to meet its decarbonisation goals, Starace says.

“The challenge of the energy transition has nothing to do with the amount of money available,” he said. An inefficient and complex authorisation process “is the limiting factor to the deployment of investments in a set amount of time. Europe is lagging in this area.”

In wind, Enel plans to continue its focus onshore at least through the time horizon of its 2021-2023 industrial plan.

“Offshore wind is still more expensive per megawatt hour than onshore wind, it freezes investments for longer and also has a different operations and maintenance profile,” said Starace. As costs come down, the offshore development process accelerates and operations and maintenance gains a stronger track record, Starace expects this could change.

As Enel prepares to grow in wind and solar, Starace is not concerned about competition in the renewable space from oil majors like Total and BP.

“The space in which we have to work will expand by about four times in the decade,” he said, adding that Enel also prefers to have competitors like these newcomers “with a solid balance sheet minding the dividends they have to pay and careful about returns.”