Forisk Wood Fiber Review: Eastern Canada Fiber Prices in Q2 2020

Energy Disrupter

ADVERTISEMENT

The economic impacts of the coronavirus continued to challenge the forest industry in Q2 2020. The pulp and paper sector tends to follow economic growth subject to its product lines, whether pressured—newsprint and copy paper—or profitable—tissue and packaging. The volatility in Q1 2020 is adequately summed by the adage, “We’re all in this together.” This saying might best be revised in Q2 to “Well, we’re all in the same storm, but we’re riding it out in different boats.” Sinking boats were made of newsprint and writing paper, while boats made of tissue and linerboard weathered the initial waves with fewer problems. Pulp and paper capacity in eastern Canada skews toward the former, rather than the latter. Increasing wood pellet production capacity in eastern Canada provides an additional market for fiber, and unlike the pulp and paper sector, industrial wood pellet production is driven by long-term offtake agreements.

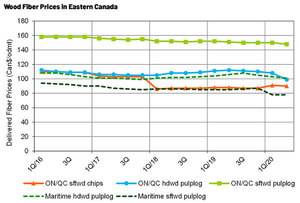

The modest price movements in Q2 2020 for most wood fiber products in eastern Canada belied turmoil within the region’s fiber markets. With the exception of softwood roundwood in the Maritime provinces, which were flat on the quarter, fiber prices declined in Q2 2020 (Figure 2). Softwood roundwood prices in Ontario and Quebec declined 1%, as did softwood chips. Meanwhile, hardwood roundwood prices declined between 2 and 8%, depending on the region. Spring breakup and lower activity in the region generally limited the number of transactions, masking the anticipated volatility in fiber markets.

The coronavirus deteriorated market conditions for printing and writing paper and has accelerated newsprint’s decline as well. Nearly 12% of eastern Canada’s pulping capacity reported some level of curtailment tied to COVID-19 impacts. Hardwood pulpwood values fell across the region as major hardwood consuming mills (many producing printing and writing paper) closed or significantly slowed operations. In the Maritime provinces, Port Hawkesbury temporarily halted wood purchases, following Northern Pulp’s closure, in an effort to reduce surplus supply. Closures of newsprint mills also impacted softwood residual chip prices. Two Resolute Forest Products mills―Amos and Baie-Comeau, Quebec―announced closures. Annual supply agreements negotiated before mill contractions supported chip prices. Prices are anticipated to decline further, however, as new contracts are signed later in the year.

The reduction in chip demand is an additional headwind to eastern Canadian lumber producers. Despite sawmill curtailments as a result of the coronavirus, which temporarily curtailed 8% of the regions softwood lumber capacity, fiber supply outstripped demand as a result of pulp and paper mill closures. One of the largest sawmills in the region, Freeman Lumber, reported its impending closure in Q2 2020, citing the inability to sell residual chips before reversing course when new supply contracts were secured.

Wood pellet production provides an additional market for chips and sawmill residuals. The region serves domestic home heating as well as international markets. Higher production volumes are anticipated as the region continues to increase capacity. Of note, Barrette-Chapais’s 210,000-metric ton (MT) Granules 777 facility in Quebec and JD Irving’s 100,000-MT Grand River Pellets mill in New Brunswick came online in 2019. La Granaudière’s 200,000-MT facility in Quebec is under construction and is expected to be operational by the end of 2020.

Since 2016, eastern Canada has represented, on average, 16% of Canada’s wood pellet export volumes. In Q2 2020, however, the region saw a material decline in export volumes, falling to 87,000 MT, a 49% decline from Q4 2019. While volumes generally trend lower in the first quarter, year-over-year Q1 2020 wood pellet exports from eastern Canada were still 23% lower than in 2019. New Brunswick represented the largest volume decline as wood pellet exports fell 74% from the previous quarter (Figure 2). The magnitude of the decline, which reflected a drop in export volume from the province to the United Kingdom, was partially a function of higher-than-average Q4 2019 export volumes. Quebec, the largest exporting province in Q1 2020, also declined from the previous quarter. The 52,000 MT of volume represented a 21% decline from Q4 2019 as exports to Italy fell 91%, reflecting low prices for fossil fuel as well as impacts from the coronavirus.

The modest price movements in Q2 2020 for most wood fiber products in eastern Canada masked turmoil within the region’s fiber markets. Managers and executives across the forest products industry adjusted production in response to the economic impacts of the coronavirus. While eastern Canada’s wood pellet capacity is increasing, the region’s pulp and paper sector declined as lumber production was curtailed. Increased fiber price volatility in the region is expected as market activity increases entering the summer.

Author: Andrew Copley

Forisk Consulting LLC

770-725-8477

acopley@forisk.com